About AvaTrade

- Strict regulation

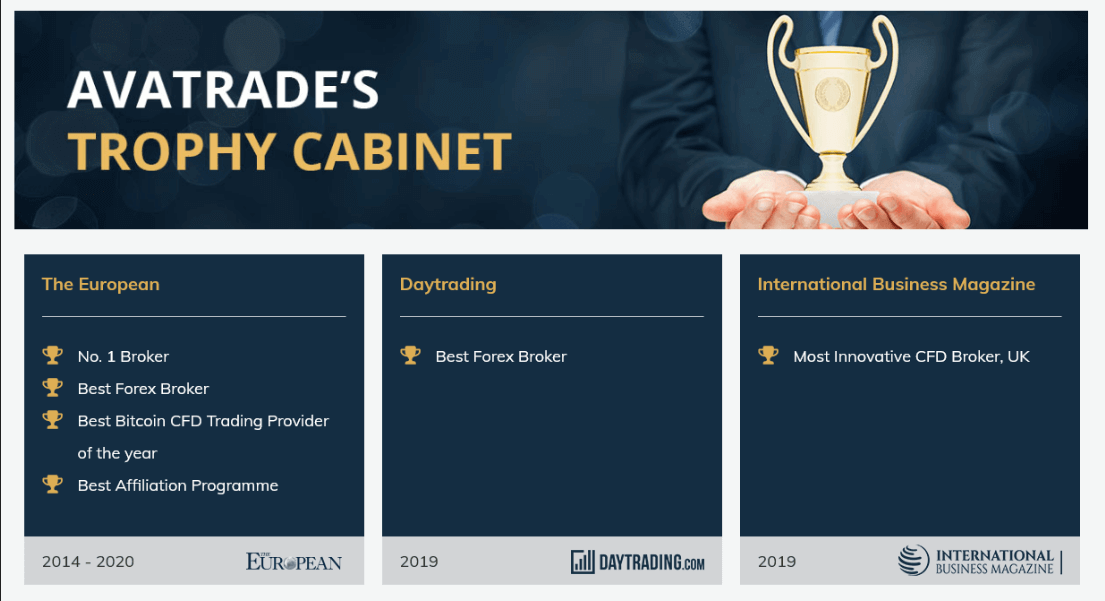

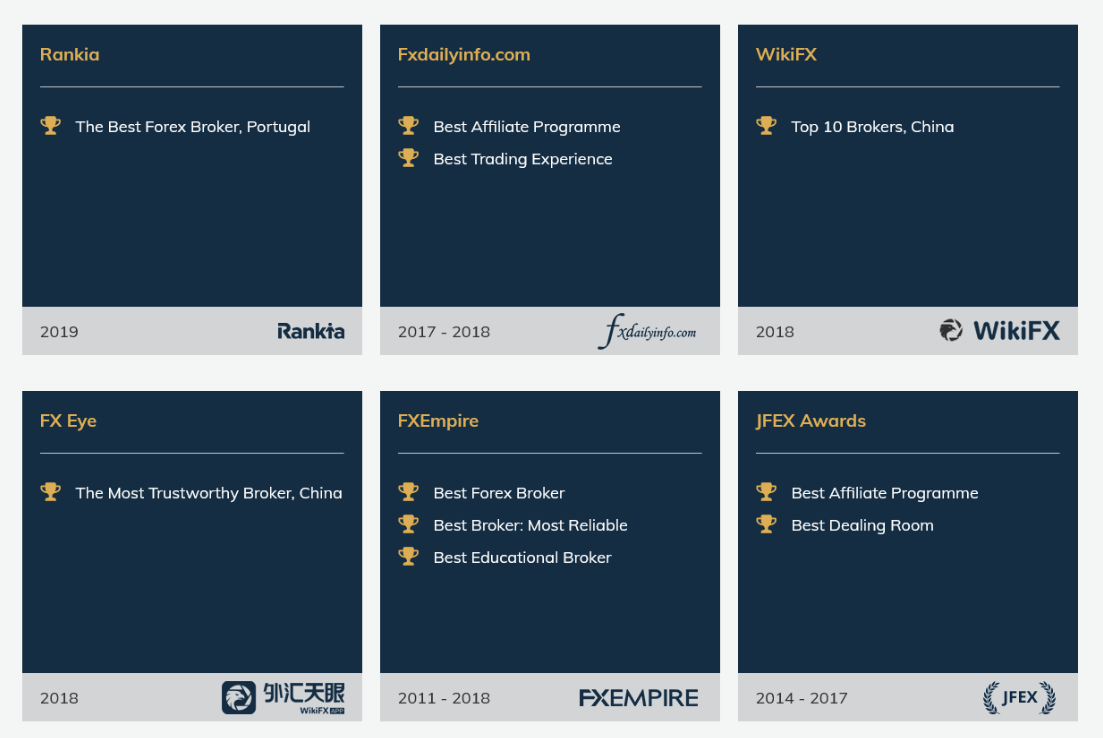

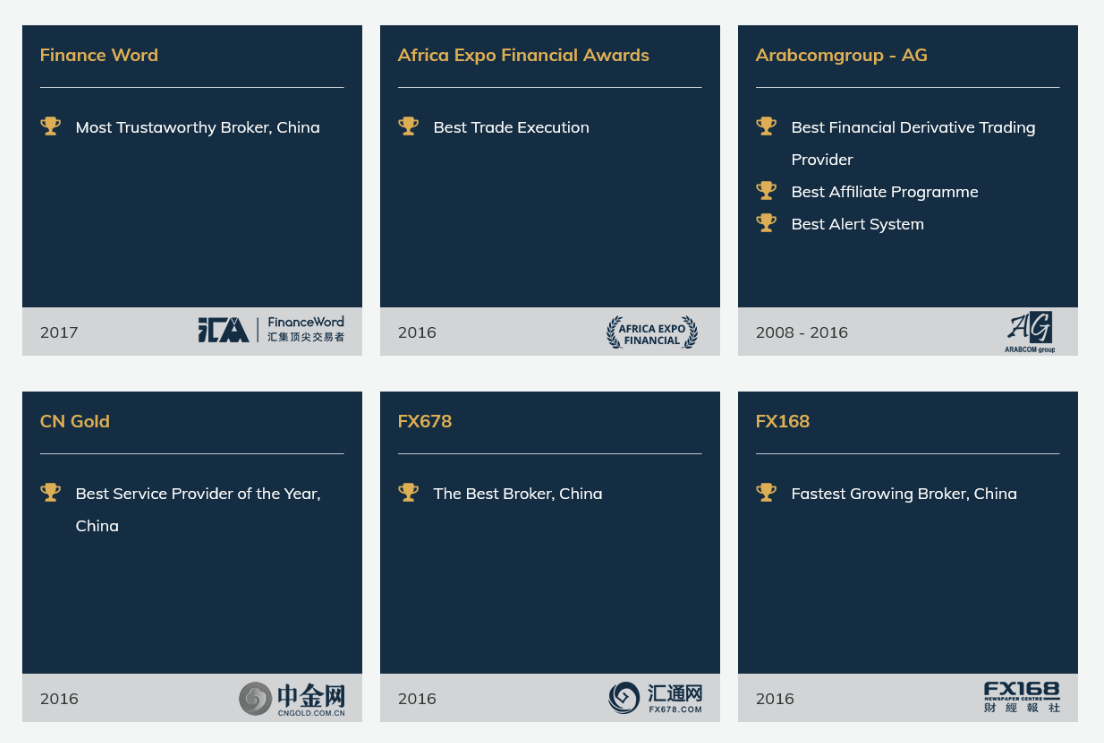

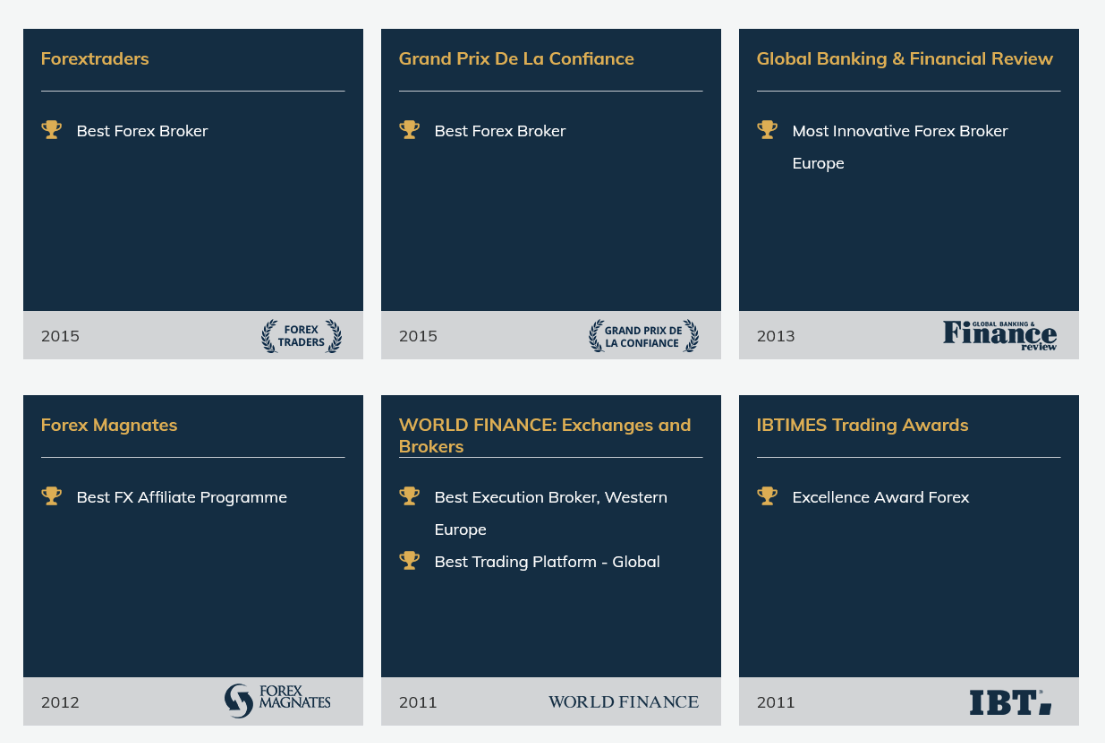

- Multiple awards

- Fast trade execution speeds

- Tight spreads

- No commission

- Powerful & flexible trading platforms

- Large selection of trading instruments

- Autochartist

- Social trading platforms

- Hedging & scalping allowed

- No deposit or withdrawal fees

- Platforms: MetaTrader 4, MetaTrader 5, AvaTradeGO, AvaOptions, DupliTrade, ZuluTrade, Web, Mobile

AvaTrade Overview

AvaTrade was incorporated in 2006 and has since gone on to become one of the worlds largest trading brokers serving over 200,000 registered clients. They have a monthly trading volume of around £60 billion with clients completing around 2 million trades per month.

AvaTrade is headquartered in Dublin, Ireland, with regional offices throughout the world including Australia, South Africa, China, Japan, France, Spain and Italy.

AvaTrade is focused primarily on the trader’s experience, combined with strong financial backing and award-winning customer service available in 14 languages 24/5.

AvaTrade Features

AvaTrade caters to all levels of traders providing an extensive range of trading instruments including Forex, Commodities, Cryptocurrency, Stocks, Shares, Indices, Metals, Energies, Options, Bonds, CFDs ETFs. There are over 1250+ instruments available to traders through multiple trading platforms for desktop, tablet and mobile. This includes the world’s most popular platform, MetaTrader 4.

AvaTrade have won multiple awards including best forex broker on numerous occasions and best trading experience. They maintain strict core values to operate with integrity and innovation, always putting the customer first and helping them to achieve their full potential through an enjoyable trading experience.

AvaTrade Awards

AvaTrade is regulated in 6 jurisdictions including Europe, Australia and South Africa, with regulatory licenses spanning 5 continents. Client funds are held in segregated accounts away from AvaTrade business funds for added security.

AvaTrade provides all levels of traders with a wide range of free educational material, trading tools and copy trading platforms via DupliTrade and ZuluTrade.

AvaTrade Overview

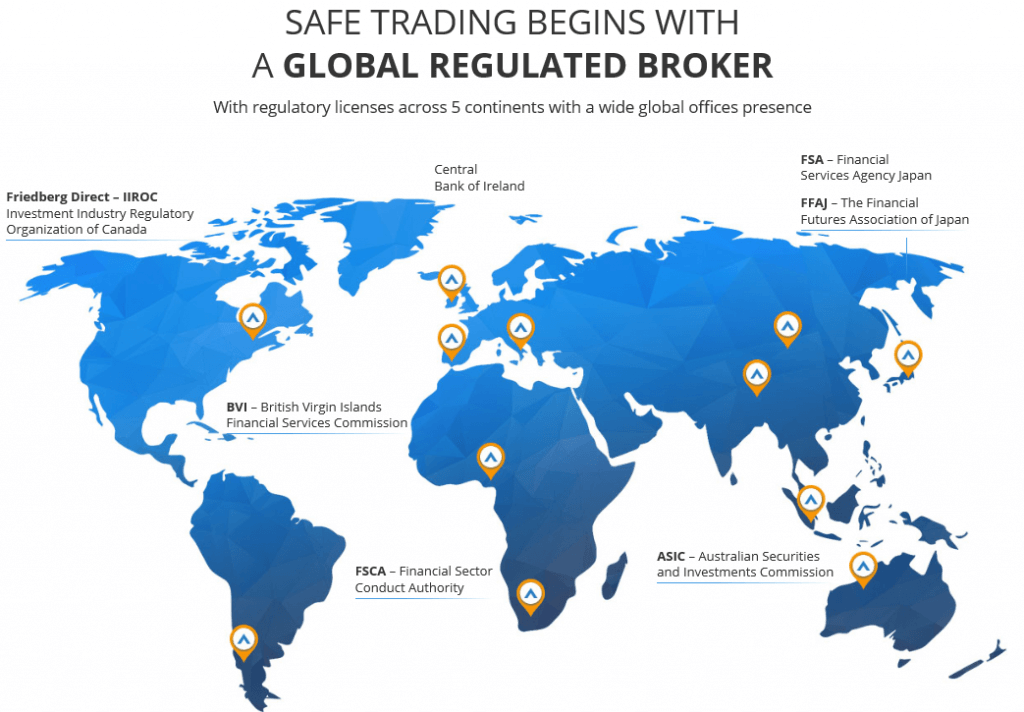

AvaTrade Regulation

AvaTrade is a regulated trading broker in the EU, Japan, Australia, South Africa and the British Virgin Islands. This means that they must comply with strict regulatory compliance rules. This applies to how they handle client funds (segregated accounts), security and reporting of financials. Trading with a broker who is regulated in numerous countries helps to give clients peace of mind that they are using a trusted and reputable trading broker.

AVA Trade EU Ltd is regulated by the Central Bank of Ireland (CBI). AVA Trade EU Ltd is a licensed investment firm compliant with the Markets in Financial Instruments Directive (MiFID). MiFID regulates investment services within the EU. It helps to provide increased customer investment protection with efficiency and transparency.

AVA Trade Ltd is regulated by the British Virgin Islands Financial Services Commission (BVI). The BVI provides licenses to companies who are operating in financial services within this territory.

Ava Capital Markets Australia Pty Ltd is regulated by the Australian Securities Investments Commission (ASIC). This is an Australian regulator that applies to Australian clients. It helps to ensure that financial services are operating in a fair and transparent manner.

Ava Capital Markets Pty is regulated by the South African Financial Sector Conduct Authority (FSCA).

Ava Trade Japan K.K. is regulated in Japan by the Financial Services Agency (FSA) and the Financial Futures Association of Japan (FFAJ).

Canadian accounts are opened with and are held by Friedberg Direct which clears trades through a subsidiary within the AvaTrade group of companies. Friedberg Direct is a division of Friedberg Mercantile Group Ltd., a member of the Investment Industry Regulatory Organization of Canada (IIROC), the Canadian Investor Protection Fund (CIPF), and most Canadian Exchanges.

AvaTrade Regulation

AvaTrade Countries

AvaTrade accepts clients from all over the world, excluding USA, Belgium and Iran. Some AvaTrade broker features and products mentioned within this AvaTrade review may not be available to traders from specific countries due to legal restrictions.

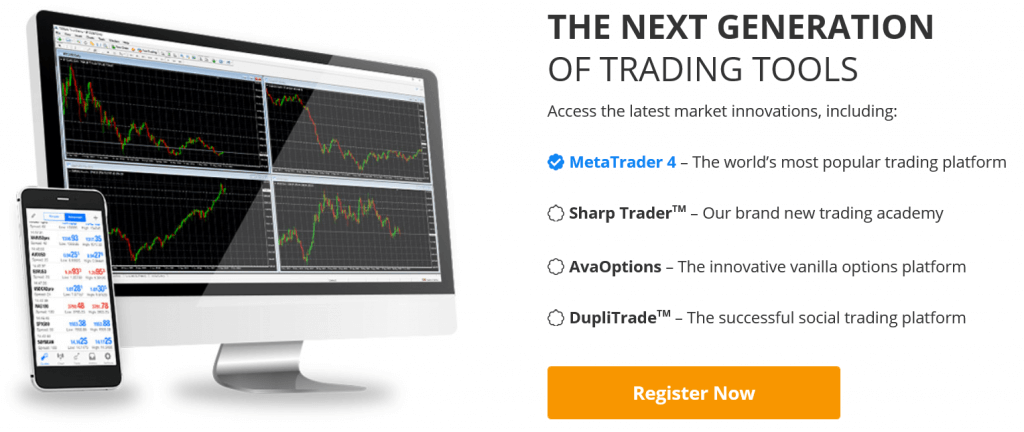

AvaTrade Platforms

AvaTrade is committed to empowering people to trade and invest online, thus they cater to every type of trader with a range of standalone and online trading platforms for traders to access markets.

These platforms are available to all levels of traders and can be selected depending on your trading requirements. You can trade multiple trading instruments on the different platforms through one account.

AvaTrade Platforms

One trader may prefer the ease of use of MetaTrader 4 whilst another may need the convenience of the AvaTradeGO app to trade from anywhere in the world at any time. AvaTrade also offer a selection of copy trading software to copy trades of other traders, DupliTrade and ZuluTrade.

Each platform provides traders with an enjoyable trading experience, presenting a variety of financial instruments across multiple markets, range of analytical tools, indicators and charts.

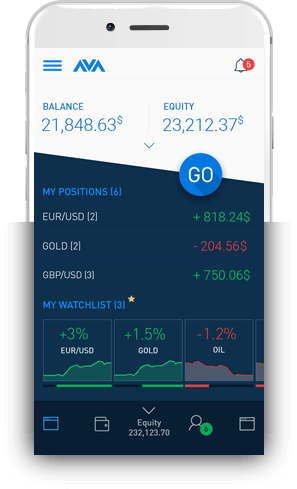

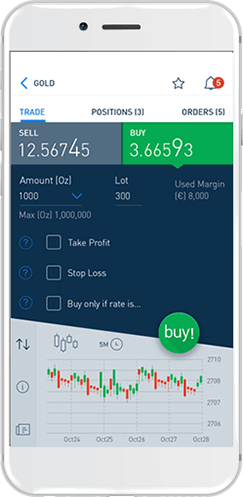

AvaTradeGO

AvaTradeGO App

You can trade on the move using the intuitive AvaTradeGO app that has a user-friendly dashboard and advanced features for fast and easy online trading from anywhere in the world. You can connect to global markets with live feeds and social trends to discover new trading opportunities on this intuitive mobile trading app.

Enjoy a smooth trading experience with a sophisticated dashboard, along with a set of intuitive position management tools, clear charts, zoom for details, and many more helpful features unique to the AvaTradeGO app.

AvaTradeGO App Intuitive Interface

With AvaTradeGO, trading can be made as simple as possible, as the app provides you with step-by-step guidance on opening trades, feedback on your activity and support any time you need it.

Users are able to manage multiple accounts from the app and switch between demo or real accounts, to get all the data you need on your trades while using your AvaTrade account credentials.

AvaTradeGO App Market Trends

Market Trends is a technology that is exclusive to AvaTradeGO. Watch markets develop in real time with this unique feature, offering a quick way to monitor social trends from the AvaTrade vibrant traders’ community. Its technological capabilities help you gain access to key financial information for clear analysis on what matters each and every day.

To help you make better and accurate decisions all your trading instruments are connected to show you insights, what other traders buy sell (market sentiment), trading behaviours, and visuals with up-to-date info.

AvaTradeGO App Unique Features

Amongst the unique trading features within the AvaTradeGO platform, you can see your trades at a glance, create your own watch lists, and view live prices and charts. Trade more than 1250 instruments including the world’s top forex pairs, commodities, stocks, cryptocurrencies and more, all from in the palm of your hand.

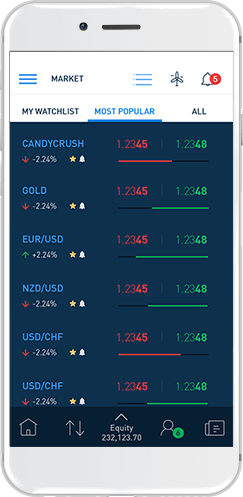

MetaTrader 4 (MT4)

AvaTrade MetaTrader 4 Platform

MT4 is one of the most popular trading platforms used by millions of traders across the globe today. MT4 offers a powerful and flexible trading environment. It is simple enough to use for new traders whilst having enough advanced functionality to suit the more professional trader. MetaTrader 4 is free to download for desktop or mobile whilst it can also run directly in your web browser without needing to download or install any additional software.

- Flexible fast online trading platform

- Fully customisable charts, layouts templates

- Built in indicators for technical and fundamental market analysis

- Copy trading signals from top providers

- Expert advisors (EAs) for automated trading

- MQL4 programming interface to create customised indicators or EAs

- Price alert notifications via email, SMS platform pop-ups

- Global accessibility from PC, web mobile (iPhone / iPad / Android / Tablet)

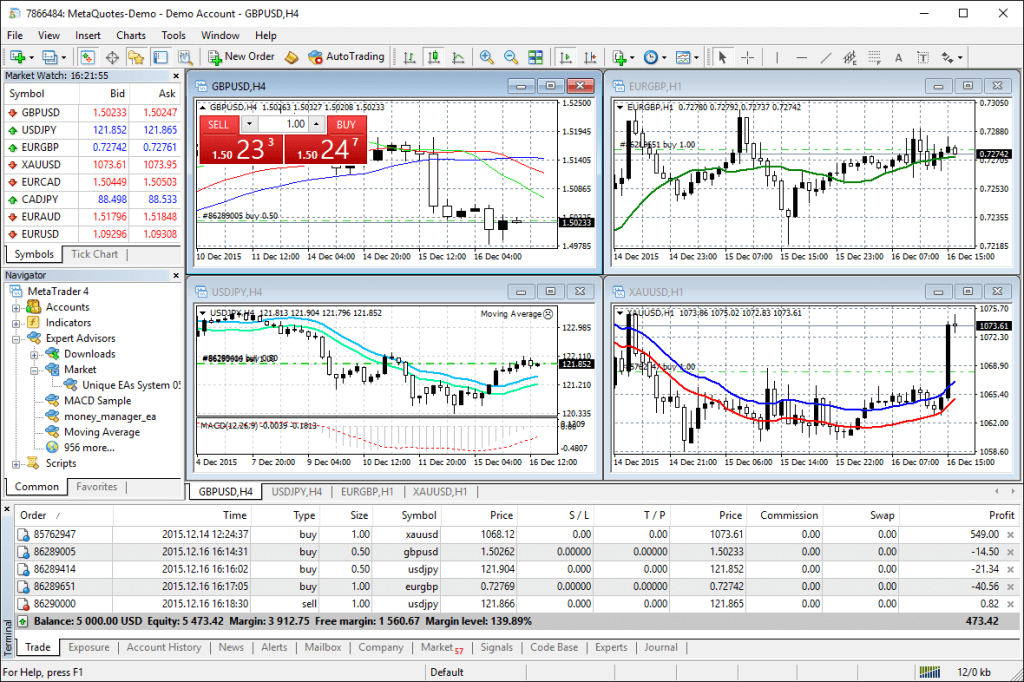

MetaTrader 5 (MT5)

AvaTrade MetaTrader 5

MetaTrader 5 is the next generation of the MetaTrader platform, offering state-of-the-art trading capabilities, more technical analysis tools, order types, timeframes, graphical objects, advanced auto trading systems and copy trading signals. Despite the additional tools and functionalities of MT5, most traders still prefer to use MT4, partly due to the fact that there are already an abundance of tutorials and tools freely available for it online.

- Maintains most of the same features as MT4 with some new additions

- New and Improved Interface for MetaTrader 5

- 38 technical Indicators for analysing the charts to detect trends ranges

- An unlimited number of charts can be opened at once

- Multi-currency EA compatibility and powerful EA testing environment

- Global accessibility from PC, web mobile (iPhone / iPad / Android / Tablet)

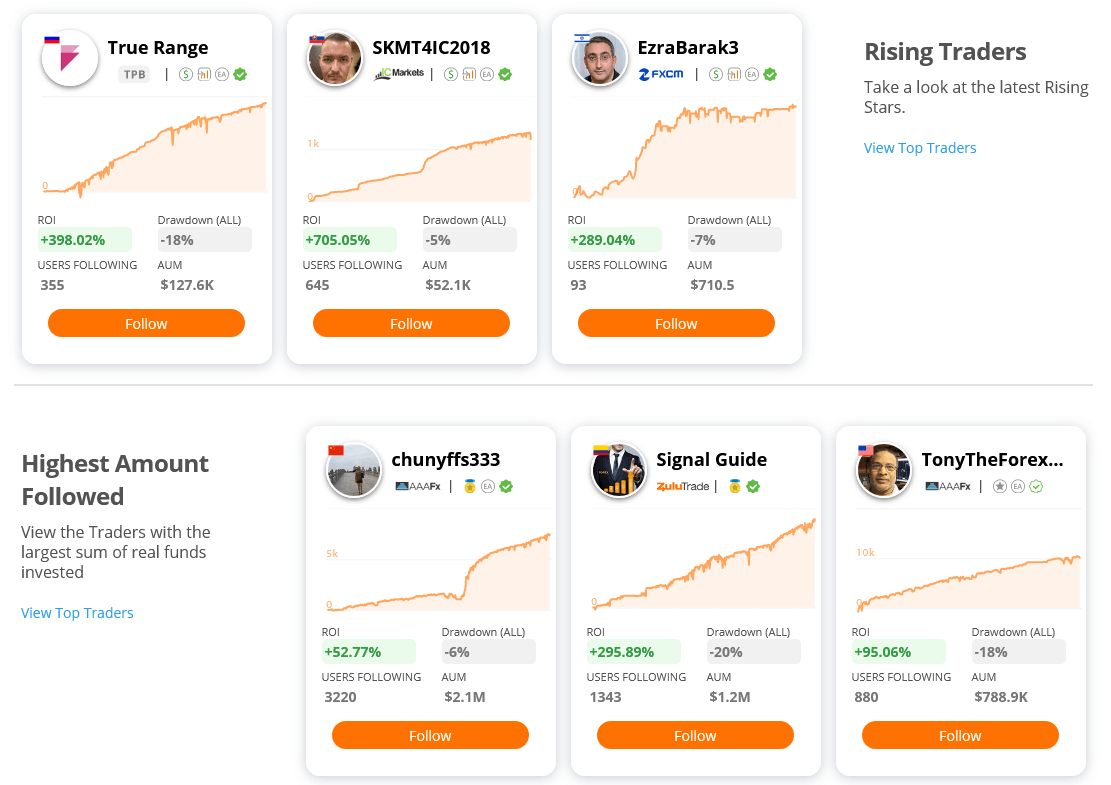

Social Trading Platforms

AvaTrade offer a selection of auto-trading software via some of the best social trading platforms that enable you to copy the trades of experienced forex traders. Automated trading platforms can mirror or copy the trades of others directly into your own trading platform / account. A trader can copy signals or mirror complete strategies, thus enjoying the experience and knowledge of other traders. The different auto trading platforms provided by AvaTrade can help those with limited time or trading knowledge to engage in trading.

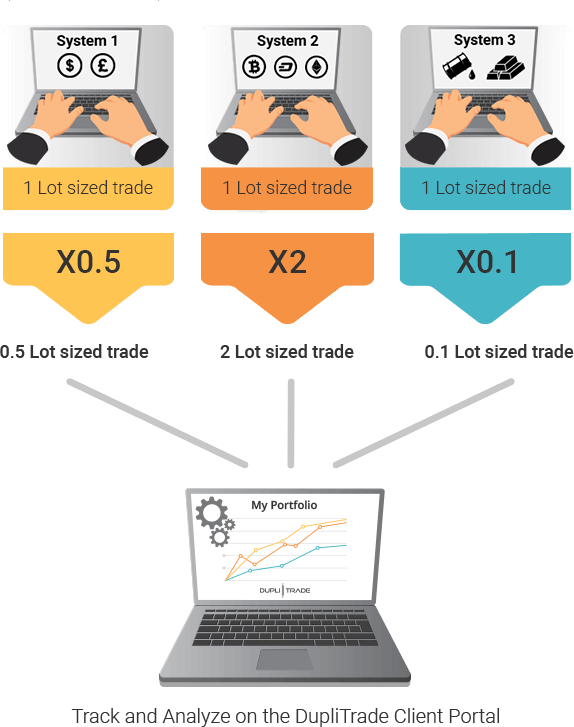

DupliTrade

DupliTrade is an MT4 compatible platform which allows traders to automatically copy trading strategies in real time according to their risk preference and trading style. It has a user-friendly interface that makes it easy to build and manage a trading portfolio whilst gaining valuable insights into other trading strategies.

DupliTrade

ZuluTrade

ZuluTrade is one of the best social trading platforms used today. ZuluTrade displays the trading strategies of other traders which you can follow for their trading signals to be copied automatically into your AvaTrade account. You can browse and filter the available trading strategies and choose those that are best suited to your individual risk preferences and trading needs. You can read our indepth ZuluTrade review for more information.

ZuluTrade

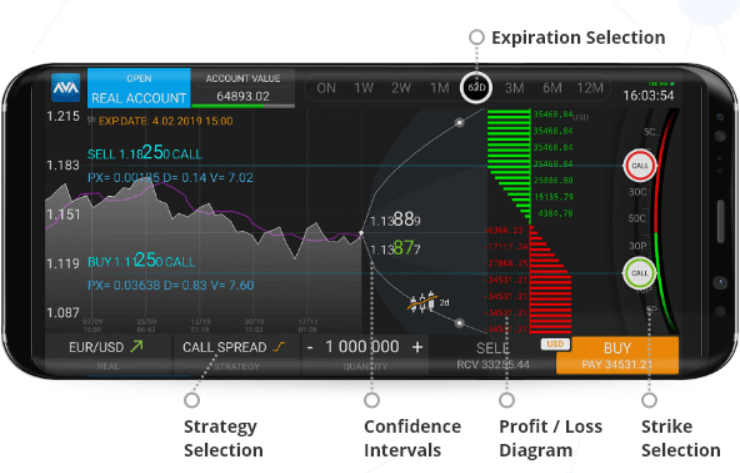

AvaOptions

AvaOptions Platform

The AvaOptions platform aims to make trading options easier via mobile or desktop. You can express your market view with calls and puts, and use the embedded tools to help try and maximise your return. There are more than 40 forex options and more for any combination of call and put options in one account to create your optimal portfolio. Execute straddles, strangles, risk reversals, spreads, and other strategies. AvaOptions gives you total control over your portfolio, letting you balance risk and reward to match your market view. AvaOptions includes professional risk management tools, portfolio simulations, and much more. Trade calls and puts which can be triggered by a pre-determined premium level, giving you added control over trade entry and exit. Trade strategies as a package for improved pricing efficiency. AvaTrade also offer full money management features to let you trade multiple accounts with one ticket.

AvaTrade Trading Tools

AvaTrade have a wide range of trading tools and services available to traders including an economic calendar to stay up to date with the latest market news, technical and fundamental analysis software, trading calculator and the latest market updates. These tools can help with analysing potential trading opportunities and benefit all levels of traders.

AvaTrade Trading Tools

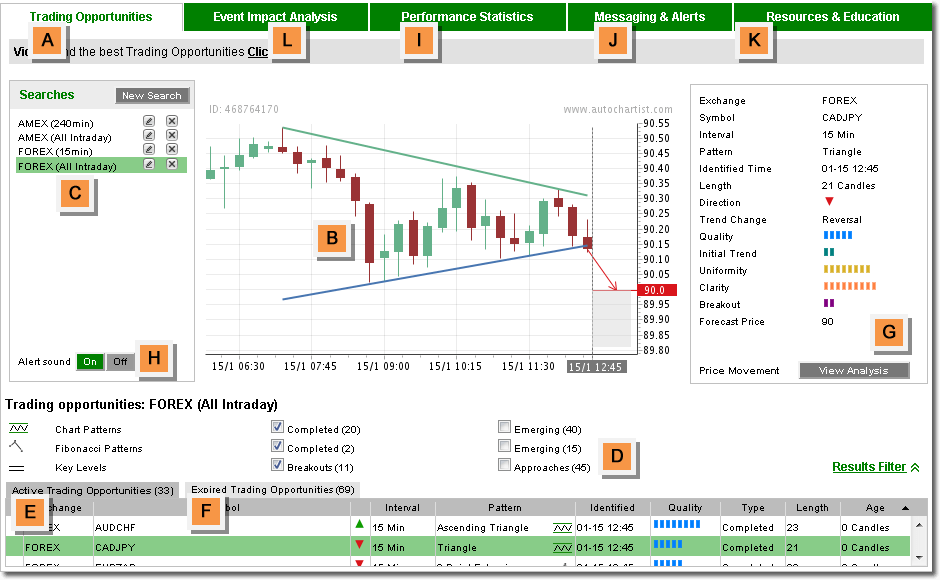

Autochartist

AvaTrade offer the award-winning automated technical analysis tool Autochartist that runs in the MetaTrader desktop and mobile platforms. Autochartist will scan and analyse the markets to identify trading opportunities across hundreds of financial instruments based on sophisticated recognition engines.

As a world leader in automated technical analysis, the Autochartist proprietary technology allows it to continuously scan the intraday markets. Its advanced recognition engine not only identifies the strongest potential trading opportunities around the clock but also helps to predict future price movements.

AvaTrade Autochartist

Autochartist’s proprietary technology is grounded on technical reviews which are based on psychological market behaviour. Its algorithms are programmed to accurately track the formation of tradable chart patterns and Fibonacci levels, as well as develop opportunities based on the Elliot Wave Theory. Whether you are a new or experienced trader, Autochartist can be of great benefit to assist with fast and efficient market analysis.

- Chart pattern recognition: Identifies chart patterns of all types – both emerging and completed – with a pattern quality indicator to help with your decisions.

- Fibonacci pattern recognition: Automatically identifies a range of simple and complex Fibonacci patterns, ranging from retracements to butterflies.

- Key level analysis: Autochartist helps you to set stops and limits by identifying support and resistance levels. The software classifies levels as either breakout or approach.

- Pattern Quality Indicator: A set of four visual indicators that allow the user to tell, at a glance, the probability of a pattern completing.

- Quality Risk Management Tools: Optimise your stop loss and take profit placements by utilising a set of 3 risk management tools that come packed with Autochartist. These are the Risk Calculator, Volatility Indicator and Statistical Analysis tool.

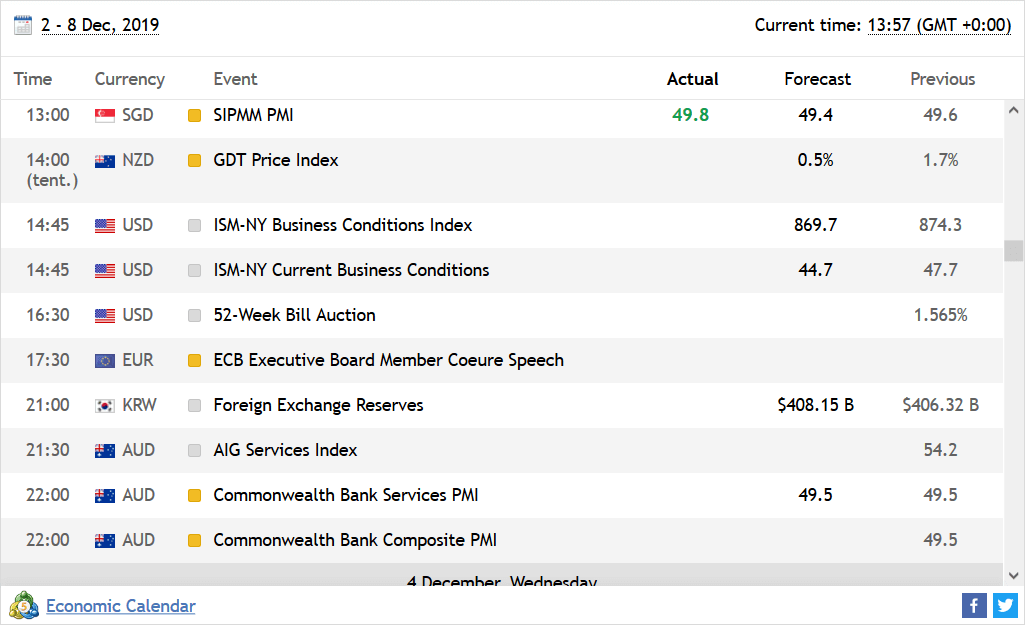

Economic Calendar

The AvaTrade global Economic Calendar comprises routine financial events which affect the financial markets. Skilled traders use these events as part of their fundamental analysis trading strategies and plan their trades in accordance. Each of these events can create changes in different instruments’ value, usually on a smaller scale.

AvaTrade Economic Calendar

AvaTrade’s Market Analysis

AvaTrade offer up to date fundamental and technical market analysis that helps to keep you informed with the latest markets movements and assist in making educated decision whilst trading. The broker offers different market analysis on the highest level in its educational site, Sharp Trader. There, one can find daily news, analysis and many other updates relevant to all instruments and platforms.

Trading Position Calculator

As a trader, knowing how to manage your risk is crucial. When trading in volatile markets, it is important to consider the potential profits, losses and costs to trading. The AvaTrade Calculator will help you to calculate these risks of your next trade before you execute it.

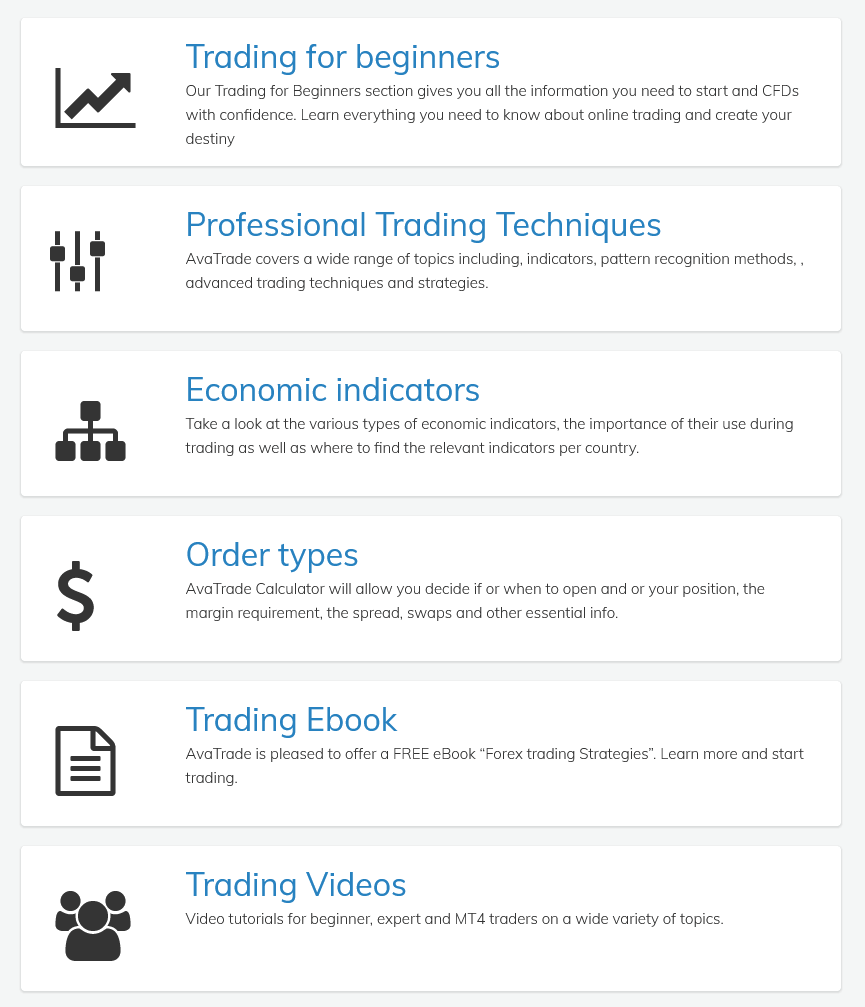

AvaTrade Education

AvaTrade has a large amount of free educational material to help improve trader’s knowledge. This includes videos, articles, e-books, daily markets and webinars in multiple languages. The educational material is beneficial to both beginner and advanced traders. The educational content covers a wide range of trading topics such as money management, trading platforms, trading strategies, technical and fundamental analysis, different markets and much more. AvaTrade is dedicated to empowering its traders to invest and trade with confidence. Knowledge and education are prominent aspects of this commitment.

AvaTrade Education

Sharp Trader

AvaTrade clients gain exclusive access to the Sharp Trader premium educational website to improve your knowledge and skills. Sharp Trader offers a wide range of educational videos, articles, daily news and trading tools. Topics covered range from the most basic to the more advanced trading strategies, taking you from trading fundamentals to the advanced strategies of leading professional traders.

SharpTrader

AvaTrade Instruments

AvaTrade have over 1250+ instruments available to traders including Forex, Commodities, Cryptocurrency, Stocks, Shares, Indices, Metals, Energies, Options, Bonds, CFDs, ETFs. They have one of the largest selections of tradeable instruments that we have come across from any broker.

There is a vast array of minor, major and exotic forex pairs, along with a generous selection of cryptocurrencies. AvaTrade CFDs include a selection of commodities and bonds while shares and ETF offerings are dominated by highly liquid big tech stocks. UK and Ireland traders can open spread betting accounts as well, rounding out a full-featured investment product catalogue.

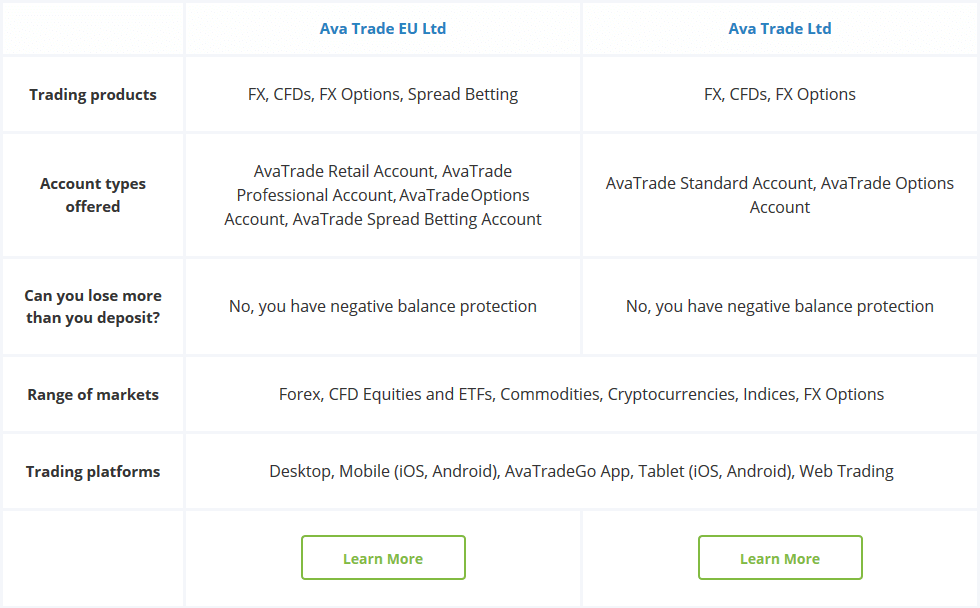

AvaTrade Accounts Fees

AvaTrade keep things simple with the trading accounts they offer. There is the standard retail account and professional account. Both offer negative balance protection with client funds being held in segregated bank accounts that are not accessible by AvaTrade. The minimum deposit to open an account is just $100. Islamic accounts that comply with Sharia law are available upon request.

To qualify for the professional account if based within the EU, you need to have made sufficient trading activity in the past 12 months, have relevant experience in the financial sector or a financial portfolio of over €500,000. This is due to strict EU regulations.

AvaTrade do not charge a commission to trade with them, instead they charge a fixed spread. There is an overnight and inactivity fee.

AvaTrade provide demo accounts if you would like to test the different trading platforms and conditions before opening a real account with them. This can be a good way to familiarise yourself with the broker before trading on a real account.

- Standard Account: $0 commission, fixed spreads from 0.9 pips

- Professional Account: $0 commission, fixed spreads from 0.9 pips

AvaTrade Accounts

As broker fees can vary and change, there may be additional fees that are not listed in this AvaTrade review. It is imperative to ensure that you check and understand all of the latest information before you open an AvaTrade broker account for online trading.

AvaTrade Support

AvaTrade’s award winning customer service is available 24/5 in 14 languages via phone, chat and email. There is always someone available to answer your questions as and when required. You can find a list of telephone numbers for each country on the brokers website along with a very thorough help centre that covers all of the topics that you would expect.

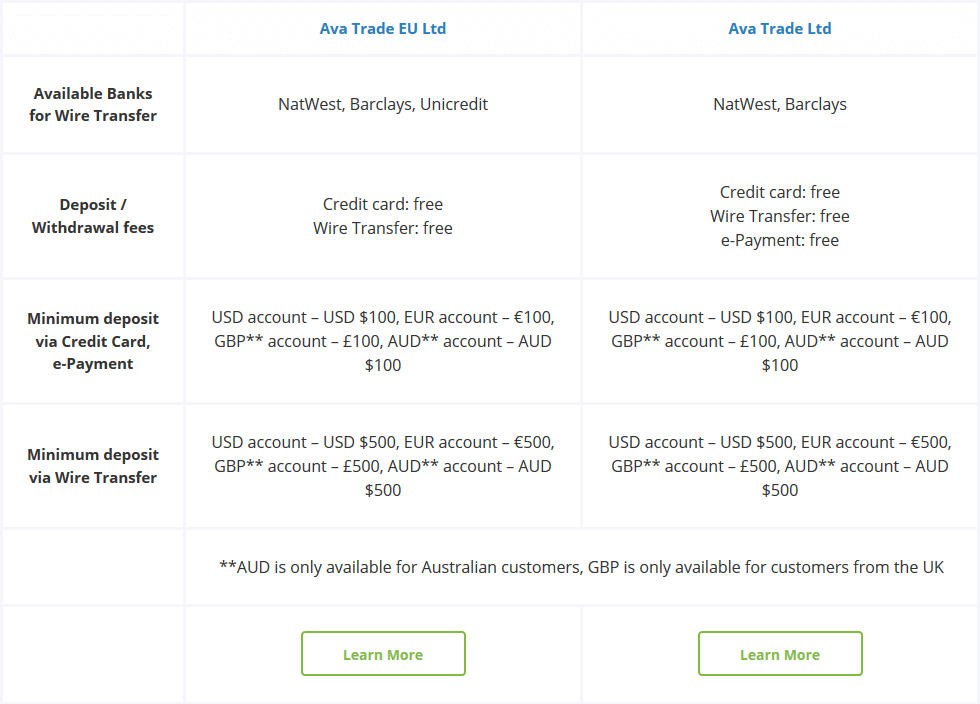

AvaTrade Deposit Withdrawal

AvaTrade offer a range of convenient and user-friendly deposit and withdrawal options, including bank transfer, credit/debit cards and online payment processors. Providing e-Wallet funding options allows for faster transfers to and from trading accounts. AvaTrade do not charge any deposit or withdrawal fees.

AvaTrade have worked hard to create streamlined and advanced processes to ensure that all withdrawals and deposits from traders are handled as quickly as possible, within a safe and secure environment. As a regulated broker, AvaTrade closely adheres to the strict regulations as laid out by the regulatory bodies, thereby guaranteeing all traders reliability, convenience and security when it comes to making a deposit or a withdrawal.

AvaTrade deposit and withdrawal options are as follows:

e-Wallets

This includes Neteller, Skrill (Moneybookers), WebMoney and others. When using these options, the funds will be credited in your account within 24 hours.

Wire Transfer

If you deposit funds via wire transfer, it can take up to 7-10 business days, depending on your banking institution and country. In order to expedite the process, you can send AvaTrade a copy of the transfer receipt to track its progress.

Credit Cards Debit Cards

If you use a credit card to make a deposit, the payment should be credited instantly into your AvaTrade account. If there is any delay, you can always contact customer support and one of the representatives will attend to the matter immediately.

They may request verification documentation as they are dedicated to providing a reliable service and safe trading environment that is within all regulations. This helps give traders the peace of mind that their personal information and funds are secure at all times.

AvaTrade does accept 3rd party deposits, but will require additional verification documentatio from both parties. In the case of a deposit made via a third party, that is not a credit card payment method, you must withdraw 100% of the deposit transaction on this initial payment method.

Accounts can be opened in USD, GBP, EUR JPY. The various different currency options are beneficial as currency conversion fees do not apply when using an account in your own currency.

AvaTrade Deposits Withdrawals

AvaTrade Account Opening

Opening an account at AvaTrade is quick and easy. You simply fill in the form on the website, confirm your email and submit identification for verification. The process takes around 10-15 minutes and once complete, you can fund your account and begin trading. Customer service is available should you need help during the process.

AvaTrade Sign-Up Form

If you make a first deposit of $1,000+ (or the equivalent on another currency), you will be assigned a dedicated account manager to guide you in your first trades, teach you how to use the trading platforms and inform you on all market matters.

AvaTrade FAQ

What is the AvaTrade minimum deposit?

The minimum deposit required by AvaTrade is just $100. This is relatively low when compared to some brokers who require deposits in the thousands. It makes AvaTrade accessible to users of all experience levels, allowing you to try out their trading service before committing a greater amount.

To be able to enjoy the full range of products offered at AvaTrade, the broker states that they recommend a starting balance of at least 1,000-2,000 of your preferred base currency. This also ensures that you receive a much more dedicated and tailored trading experience, as well as being an optimal balance for trading with. Of course, you should only trade with money you can afford to lose, as trading comes with inherent risks.

How do I deposit money into AvaTrade?

AvaTrade provide clients with a range of safe and secure deposit options including credit cards (excluding Canada) and wire transfer. They also offer deposits via e-payments such as Skrill, WebMoney and Neteller.

Once your account has been approved and verified you can access deposit options right in the trading platform and easily deposit to start trading. You’ll be able to use a bank wire and credit or debit cards to fund your account quickly. And depending on what country you reside in you’ll also be able to choose from a large variety of online e-Wallets.

To make a deposit, the first step is to log in to your AvaTrade account. Click on the ‘Deposit’ section and select your preferred deposit method. Please also ensure that you have selected the specific trading account you wish to deposit into from the drop-down menu. If you have not made any trades, deposits can be cancelled within 24 hours by contacting the AvaTrade customer support team.

What are the AvaTrade deposit fees?

AvaTrade do not charge any fees or commissions on deposits made into your trading account. However, you may be subject to the fees that can be charged by the payment method provider of your choice or your bank.

How do I withdraw money from AvaTrade?

You can withdraw money from your AvaTrade account using the same methods accepted for deposits, such as Wire Transfer, Credit or Debit Card and digital e-Wallets.

As a regulated broker, AvaTrade need to operate within strict regulatory requirements. As a result of international anti-money laundering regulations, withdrawals can only be sent via the payment methods by which you funded your account.

AvaTrade pride themselves on offering an exceptional service and meeting the needs of their clients. It takes only 24-48 hours to complete the withdrawal process once your account has been verified. This is the process for credit cards, debit cards and e-money. In the case of wire transfers, it can up to 10 business days for the funds to reflect in your account. Please check the delay times with your banking institution.

It is very important to note that you must withdraw up to 200% of your deposit to your credit or debit card. After this, you may then withdraw funds by another method, as per your instructions, but it must be in your own name.

What are the AvaTrade withdrawal fees?

AvaTrade do not charge any fees or commissions on withdrawals made from your trading account. However, you may be subject to the fees that can be charged by the payment method provider of your choice or your bank.

What is the AvaTrade commission fee?

AvaTrade does not charge commissions on any trade as they are compensated through the Bid-Ask spread, except when otherwise stated. This can help you to save on trading costs in the long term.

Are there any AvaTrade inactivity fees?

Yes, AvaTrade charge a $50 inactivity fee after 3 consecutive months of non-use and every successive Inactivity Period. The inactivity fee is deducted from the clients trading account. After 12 consecutive months of non-use, an administration fee of $100 will be deducted from the value of the Customer’s trading account. Applicable fees are subject to change.

What are the AvaTrade account types?

AvaTrade keep things nice and simple with a choice between a retail and a professional account. The retail account is specially tailored to cater a wide range of client needs, regardless of your previous trading experience. It features very competitive and transparent fees, along with a variety of excellent features.

The primary difference between a retail account and a professional account is the maximum amount of leverage available for use. Retail account holders are restricted to the European Union’s legal limit of 1:30 on forex instruments (for the safety of the trader), while professional account holders may utilize leverage as high as 1:400 on forex pairs.

Is there an AvaTrade demo account?

You can open a free demo account with AvaTrade and receive $100,000 of virtual money for practicing your trading strategy. The demo trading account enables you to try out the platform and its many features, and to get the opportunity to trade within a live trading environment without the risk of losing any money. Once you feel confident enough to start trading online, you can open a real account and make a deposit.

What are the AvaTrade spreads?

AvaTrade have very low spreads, starting from just below 1 pip on the EURUSD at around 0.9 pips. This is extremely competitive when you consider they do not charge a commission fee as many other brokers do. Furthermore, those who qualify for a professional account get even lower spreads, starting from around 0.6 pips on the EURUSD. Spreads are variable depending on the market conditions and available liquidity.

What is the AvaTrade leverage?

AvaTrade have many instruments to choose from, and each has a different leverage which can also change based on the chosen platform by the trader. On MetaTrader you can enjoy between 1:30 and 1:400 leverage. Most forex pairs have the highest leverage, some metals such as gold are 20:1, as well as crude oil, silver and other metals is limited to 10:1 leverage.

It is important to make sure the leverage on the specific platform before you commence you trades, and in order to avoid a margin call always make sure you have enough equity in your account’s balance so you can continue your trades undisturbed.

What are the AvaTrade margin stop out levels?

AvaTrade UK requires a retail trader to possess equity of at least 50% of the used margin for MetaTrader 4 and AvaOptions accounts. If the trader has losses and the equity drops below 50% of used margin on MetaTrader 4 and AvaOptions accounts, the broker will shut down the client’s position(s), which is called a “Margin Call”. On AvaOptions all the client’s positions will be closed, while MetaTrader 4 will shut down the largest losing position first, and will continue to close positions until the equity level returns above 50% of the used margin.

AvaTrade EU traders must possess equity of at least 10% of the used margin for MetaTrader 4 and AvaOptions accounts. If the trader has losses and the equity drops below 10% of used margin on MetaTrader 4 and AvaOptions accounts, the broker will shut down the client’s position(s), which is called a “Margin Call”. On AvaOptions all the client’s positions will be closed, while MetaTrader 4 will shut down the largest losing position first, and will continue to close positions until the equity level returns above 10% of the used margin.

Do AvaTrade allow hedging, scalping and news trading?

Yes, AvaTrade allow most trading strategies including scalping, hedging, news trading and automated trading.

Is there an AvaTrade Islamic account?

AvaTrade do offer an Islamic trading account that has been tailored to meet the needs of Muslim clients. After funding, you can apply for an Islamic account, which operates under the Sharia Law. Your request will then be forwarded to the relevant department for review and approval. Requests are usually processed within 1-2 business days.

What are the AvaTrade trading instruments?

AvaTrade have a wide variety of tradable instruments including Forex, Commodities, Cryptocurrency, Stocks, Shares, Indices, Metals, Energies, Options, Bonds, CFDs and ETFs. There are thousands of instruments to choose from with something to suit everyone’s interests.

How do I open an AvaTrade live account?

Opening an account with AvaTrade is quick and easy. Simply follow these 3 steps:

- From the main page on the AvaTrade website, click on Register now, choose either a Real or Demo account.

- Fill in your name and email address, choose either individual or joint account and click on Create account.

- Fill in and complete the registration form, and Verify your account.

How do I verify my AvaTrade account?

In order to verify your AvaTrade account, you will need to provide the following documents:

- Proof of ID – A valid government-issued ID (e.g. Passport, ID card, driver’s license), containing the following information: name, picture and date of birth. (must match the information you registered your account with).

- Proof of Address – A utility bill for address verification (e.g. electricity, water, gas, mobile or land-line phone, etc) containing your name, address, and issued date – not older than six months (must match the ones you registered with).

What is the AvaTrade trading platform?

AvaTrade are committed to catering to the needs of different traders and therefore offer a wide-selection of trading platforms for both manual and automated trading, across a variety of device types. You can choose between the following platforms, MetaTrader 4, MetaTrader 5, AvaTradeGO, AvaOptions, DupliTrade and ZuluTrade.

The goal is to ensure that each of the platforms provide traders with a seamless and enjoyable trading experience. Each platform has a wide selection of instruments, including cryptocurrencies, to choose from along with multiple analytical tools, indicators and charts.

Where can I download the AvaTrade platform?

You can download any of the AvaTrade trading platforms directly from the brokers website or the relevant app stores. All of the trading platforms come without any costs or strings attached. That means you are free to download one or all of them, and it won’t cost you a thing.

Where is AvaTrade located?

AvaTrade is headquartered in Ireland, where its regulator is the Central Bank of Ireland and is a member of the Investor Compensation Company DAC (ICCL), which provides eligible clients up to EUR 20,000 of maximum reimbursement in the extraordinary event of their broker’s insolvency. The broker also has offices located around the globe.

Is AvaTrade regulated?

Yes, AvaTrade is licensed as a regulated broker in the EU, Japan, Australia, South Africa, UAE and the British Virgin Islands. As such, they are subject to stringent compliance requirements regarding how they handle client funds, security, and financial reporting.

AvaTrade are one of the most highly regulated trading brokers out there. Using a regulated broker help to give traders the confidence and trust that they are using a transparent and reliable broker that can offer some protection in a worst-case scenario.

What countries do AvaTrade accept?

Almost all countries are accepted by AvaTrade, with a few exceptions including the US, Belgium and Iran.

Is AvaTrade a scam?

No, AvaTrade is not a scam. They are a very well-respected, established and regulated broker that has been offering a range of different products and services to traders around the globe, since 2006.

How can I contact AvaTrade support?

The AvaTrade support team is available by phone, email and live chat, so you’ll always have someone to talk to – in your language – whenever the markets are open. You can also reach AvaTrade on Facebook. Impressively, customer support representatives monitor and respond to comments on social media on a daily basis.

AvaTrade Summary

AvaTrade in our opinion, are without doubt one of our best brokers for trading online, whatever your experience level. They have very strict regulation in multiple jurisdictions to protect clients and offer an excellent range of trading instruments across different asset classes.

The trading platforms on offer are easy to use and suitable for different types of traders, providing an enjoyable trading experience with low spreads, low commissions fees and rapid trade execution speeds.

The broker also provides plenty of trading tools and educational materials free of charge to clients whilst the customer support team are available to answer any questions in a prompt and friendly manner.

AvaTrade customers can trade in peace, knowing they are in good hands. Their award-winning customer service representatives are ready to assist with any trading issue you may have. The service, combined with a deep understanding of the financial markets, allow traders to enter the markets with confidence.