How to Trade Forex on AvaTrade

How to place a New Order on AvaTrade MT4

Firstly, you need to set up the AvaTrade MT4 platform on your device and log in, if you don’t know how to log in to AvaTrade MT4, see this article: How to Login to AvaTrade.

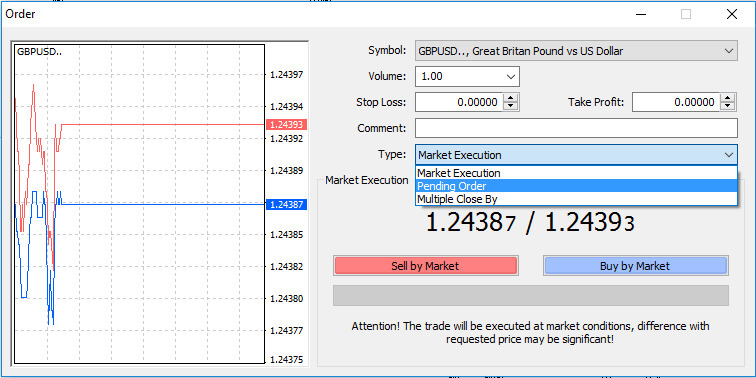

You can initiate a new order by either right-clicking on the chart and selecting "Trading" → "New Order" or by double-clicking on the desired currency in MT4, which will prompt the Order window to appear.

Volume: Determine the contract size by clicking the arrow and selecting the volume from the provided options in the dropdown box. Alternatively, left-click in the volume box and input the desired value. Remember that the contract size directly impacts potential profit or loss.

Comment: While not mandatory, you can use this section to label your trades with additional comments.

Type:

- Defaults to market execution, where orders are executed at the current market price.

- A Pending Order is an option for specifying a future price for opening a trade.

Lastly, choose the order type – either sell or buy. Sell by Market opens at the bid price and closes at the asking price, potentially yielding profit if the price drops. Buy by Market opens at the asking price and closes at the bid price, potentially resulting in profit if the price rises.

Upon selecting Buy or Sell, your order will be swiftly processed, and you can track it in the Trade Terminal.

How to place a Pending Order on AvaTrade MT4

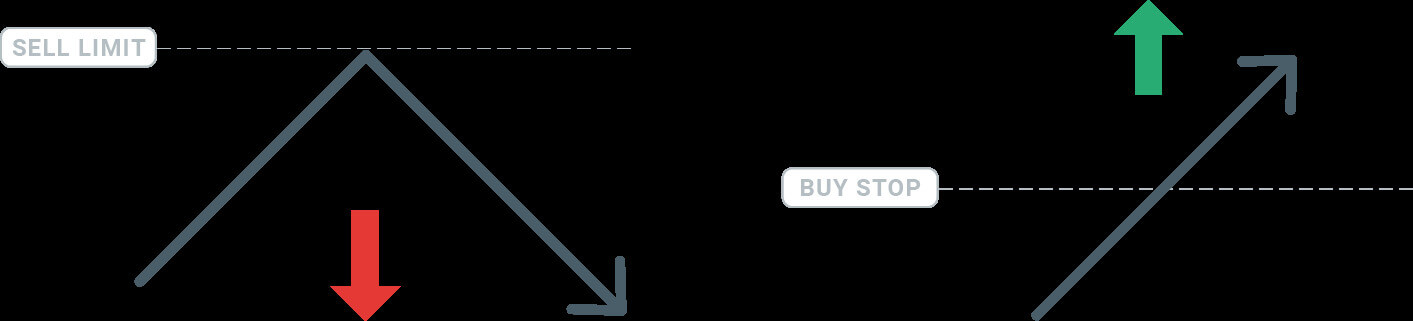

How Many Pending Orders

In contrast to immediate execution orders, which involve placing a trade at the current market price, pending orders enable you to establish orders that are triggered once the price reaches a specific level determined by you. While there are four types of pending orders, they can be categorized into two primary types:

- Orders anticipating a breakthrough of a particular market level.

- Orders anticipating a rebound from a specific market level.

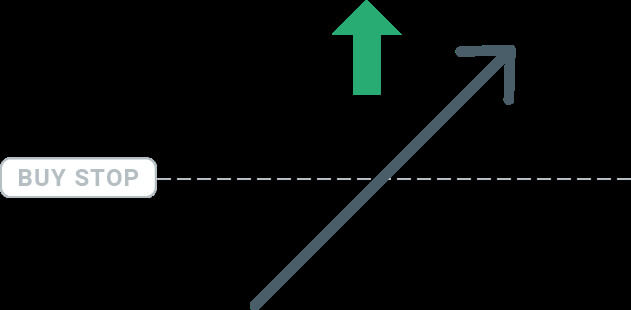

Buy Stop

The Buy Stop order enables you to place a purchase order at a price higher than the current market value. In practical terms, if the present market price is $17 and your Buy Stop is set at $30, a buying or long position will be initiated when the market reaches the specified $30 price level.

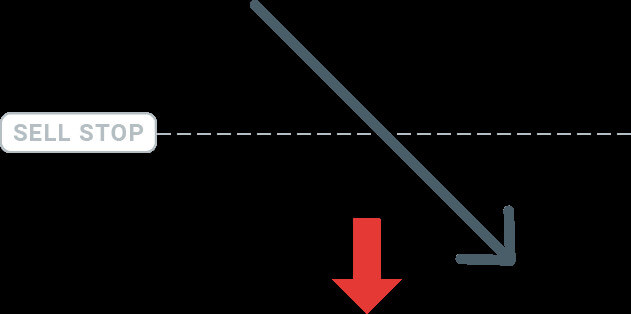

Sell Stop

The Sell Stop order empowers you to place a sell order at a price lower than the current market value. Therefore, if the existing market price is $40 and your Sell Stop price is set at $26, a selling or ’short’ position will be initiated when the market reaches the designated $26 price level.

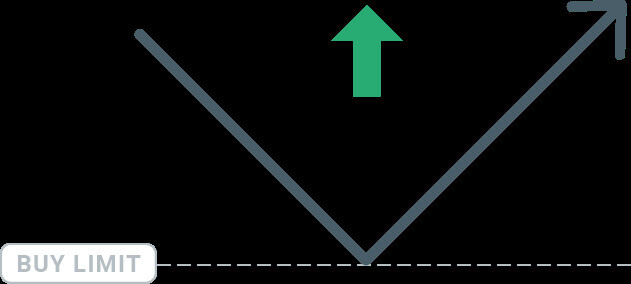

Buy Limit

Contrary to a buy stop, the Buy Limit order permits you to establish a purchase order at a price lower than the current market value. In practical terms, if the present market price is $50 and your Buy Limit is set at $32, a buying position will be initiated when the market reaches the specified $32 price level.

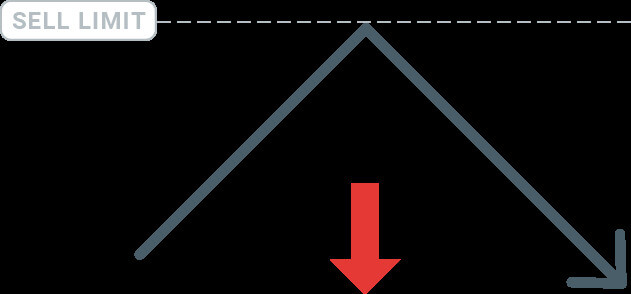

Sell Limit

Ultimately, the Sell Limit order enables you to place a sell order at a price higher than the current market value. In practical terms, if the existing market price is $53 and the designated Sell Limit price is $67, a selling position will be initiated when the market reaches the specified $67 price level.

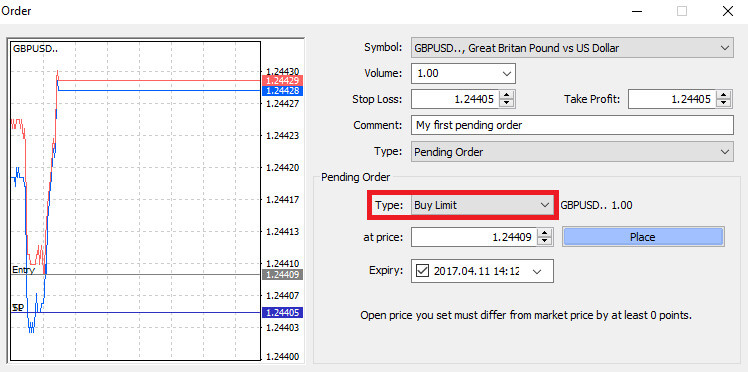

Opening Pending Orders

You can initiate a fresh pending order with ease by double-clicking on the market name in the Market Watch module. Upon doing so, the window for a new order will open, allowing you to switch the order type to Pending order.

Afterward, pick the market level at which the pending order will trigger. Additionally, determine the position size based on the volume. If needed, you can establish an expiration date (’Expiry’). Once all these criteria are configured, choose the appropriate order type depending on whether you want to go long or short, and set the stop or limit. Finally, click on the ’Place’ button to execute the order.

As evident, MT4’s pending orders are robust functionalities. They prove especially beneficial when you’re unable to monitor the market continuously for your entry point or when the price of an instrument fluctuates rapidly, and you aim to seize the opportunity without missing it.

How to close Orders on AvaTrade MT4

To conclude an active position, select the "X" icon within the Trade tab located in the Terminal window.

Alternatively, you can right-click on the order line on the chart and choose the "Close" option.

If you wish to close only a portion of your position, click the right mouse button on the open order and choose "Modify". Then, within the Type field, opt for instant execution and specify the portion of the position you intend to close.

As evident, initiating and concluding your trades on MT4 is highly user-friendly, requiring a single click.

Using Stop Loss, Take Profit, and Trailing Stop on AvaTrade MT4

A crucial aspect of long-term success in financial markets lies in careful risk management. Incorporating stop losses and take profits into your trading strategy is essential. Let’s explore how to utilize these tools on our MT4 platform, ensuring you can effectively control risk and optimize your trading potential.

Setting Stop Loss and Take Profit

The most straightforward method to incorporate a Stop Loss or Take Profit into your trade is to apply them immediately when initiating new orders.

To implement this, simply input your specific price level in the Stop Loss or Take Profit fields. Keep in mind that the Stop Loss is automatically triggered if the market moves unfavorably against your position (hence the term "Stop Losses"), while Take Profit levels are executed automatically when the price reaches your designated profit target. This flexibility allows you to set your Stop Loss level below the current market price and the Take Profit level above the current market price.

It’s crucial to note that a Stop Loss (SL) or a Take Profit (TP) is always associated with an open position or a pending order. You can adjust both parameters once your trade is active, and you’re actively monitoring the market. While these are protective measures for your market position, they are not mandatory for opening a new position. You have the option to add them later, but it is highly recommended to consistently safeguard your positions.

Adding Stop Loss and Take Profit Levels

The most straightforward method to attach Stop Loss (SL) or Take Profit (TP) levels to your existing position is by utilizing a trade line on the chart. Just drag and drop the trade line to the desired level, either upward or downward.

After inputting the Stop Loss (SL) or Take Profit (TP) levels, corresponding lines will be visible on the chart. This enables you to easily and promptly adjust SL/TP levels.

You can also perform this action from the "Terminal" module at the bottom. To add or modify SL/TP levels, right-click on your open position or pending order, and select "Modify or delete order".

The order modification window will emerge, providing you with the capability to input or adjust Stop Loss (SL) and Take Profit (TP) either by specifying the exact market level or by defining the points range from the current market price.

Trailing Stop

Stop Losses are designed to mitigate losses if the market moves unfavorably against your position, but they can also be instrumental in securing your profits.While this concept may initially seem counterintuitive, it is, in fact, quite straightforward to comprehend and master.

Imagine you’ve initiated a long position, and the market is currently moving in a favorable direction, resulting in a profitable trade. Your original Stop Loss, initially placed below your opening price, can now be adjusted to your opening price (ensuring a break-even scenario) or even above the opening price (guaranteeing a profit).

For an automated approach to this process, you can employ a Trailing Stop. This proves to be a valuable tool in risk management, especially during rapid price changes or when continuous market monitoring is not feasible.

Once the position becomes profitable, the Trailing Stop will automatically track the price, maintaining the pre-established distance.

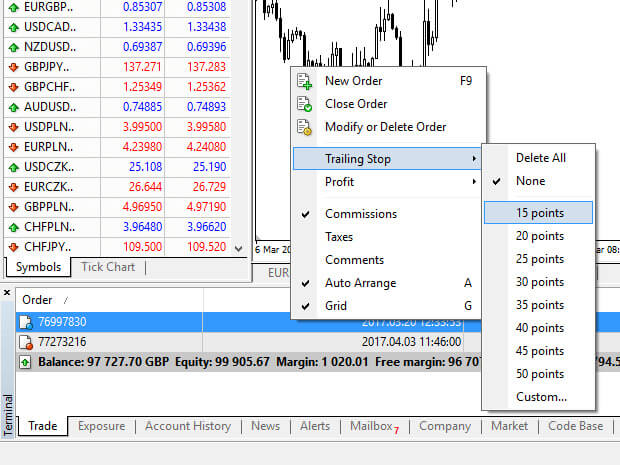

Trailing Stops (TS) are linked to your active positions, and it’s crucial to note that for a Trailing Stop on MT4 to be executed successfully, the platform must remain open.

To establish a Trailing Stop, simply right-click on the open position within the "Terminal" window and indicate the preferred pip value as the distance between the Take Profit (TP) level and the current price in the Trailing Stop menu.

Your Trailing Stop is now active, meaning that in the event of favorable market price changes, the Trailing Stop will automatically adjust the stop loss level.

To deactivate the Trailing Stop, simply choose "None" in the Trailing Stop menu. If you wish to swiftly disable it across all open positions, select "Delete All".

As demonstrated, MT4 offers multiple ways to safeguard your positions in a matter of moments.

While Stop Loss orders are among the most effective methods to manage risk and control potential losses within acceptable limits, they do not provide complete security.

Stop losses are cost-free and serve to shield your account against adverse market shifts. However, it’s essential to be aware that they do not guarantee the execution of your position every time. In instances of sudden market volatility or price gaps beyond your stop level, there is a possibility that your position may be closed at a less favorable level than requested. This occurrence is known as price slippage.

For enhanced protection without the risk of slippage, guaranteed stop losses are available at no cost with a basic account. These ensure that your position is closed out at the requested Stop Loss level even if the market moves against you.

Frequently Asked Questions (FAQ)

How will a news release affect my trade?

Positive news for the “Base” currency, traditionally results in an appreciation of the currency pair. Positive news for the “Quote” currency, traditionally results in a depreciation of the currency pair.Therefore it can be said that: Negative news for the “Base” currency traditionally results in a depreciation of the currency pair. Negative news for the “Quote” currency traditionally results in an appreciation of the currency pair.

How do I calculate my profit and loss on a trade?

The foreign exchange rate represents the value of one unit in the major currency in terms of a secondary currency.

When opening a trade, you execute the trade in a set amount of the major currency, and when closing the trade you do so in the same amount, the profit or loss generated by the round trip (open and close) trade will be in the secondary currency.

For example; if a trader sells 100,000 EURUSD at 1.2820 and then closes 100,000 EURUSD at 1.2760, his net position in EUR is zero (100,000-100,000) however his USD is not.

The USD position is calculated as follows 100,000*1.2820= $128,200 long and -100,000*1.2760= -$127,600 short.

The profit or loss is always in the second currency. For simplicity’s sake, the PL statements often show the PL in USD terms. In this case, the profit on the trade is $600.

Where can I see my trading history?

Access your trading history via the reports feature that is available directly from MetaTrader4. Make sure that the "Terminal" window is open (if it’s not, go to the "View" tab and click on "Terminal").

- Go to "Account history" on the Terminal (bottom tab bar)

- Right-click anyplace - Select "Save as Report" - click "Save". This will open your account statement which will open in your browser on a new tab.

- If you right-click on the browser page and select “Print” you should have the option to save as PDF.

- You will be able to save or print it directly from the Browser.

- More information on the reports can be found on the "Client Terminal - User Guide" in the "Help" window on the platform.

Why should I trade options when I can use leverage in spot trading?

Options allow you to trade with unbalanced risk. This means that your risk profile is not the same in both market directions.

So, while you CAN use Options as a leveraged instrument (buying an option costs a fraction of the cost of the underlying asset), the real advantage of Options is the ability to tailor your risk profile to fit your market view.

If you are right, you profit; if you are wrong, you know your downside risk is limited right from the beginning of the trade, without needing to leave stop-loss orders or exit your trades.

With Spot trading, you may be right about the ultimate direction of the market but not reach your goal. With Options, you can allow a properly structured trade to complete your goal.

What are the risks and rewards of margin trading?

Margin trading provides greater potential returns on the capital invested. However, traders need to be aware with greater potential returns, also comes greater possible losses. Therefore, this is not for everyone. When trading with significant amounts of leverage, a small market move can have a substantial impact on a trader’s balance and equity, both positive and negative.

Elevate Your Trading Journey: Unleash the Power of AvaTrade Mastery!

Embark on a path of financial empowerment with ’How to Trade on AvaTrade. From mastering the markets to navigating the intricacies of trading, our guide is your key to unlocking success. Trade confidently, trade smartly – because at AvaTrade, your journey to financial achievement begins here.