How to Withdraw and make a Deposit on AvaTrade

How to Deposit on AvaTrade

Deposit Tips on AvaTrade

Funding your AvaTrade account is a seamless process with these convenient tips for hassle-free deposits:

- The payment methods on our platform are conveniently grouped into those available for immediate use and those accessible after completing the account verification process. Ensure your account is fully verified by having your Proof of Identity and Residence documents reviewed and accepted to unlock our complete payment method offerings.

- Standard accounts’ minimum deposit varies depending on the payment system chosen, while Professional accounts have a set minimum initial deposit starting from USD 200. Be sure to verify the minimum deposit requirements for the specific payment system you plan to use.

- Ensure that the payment services you utilize are registered under your name, matching the name on your AvaTrade account. When selecting your deposit currency, remember that withdrawals must be made in the same currency chosen during the deposit. While the deposit currency doesn’t have to match your account currency, note that exchange rates at the time of the transaction will apply.

Lastly, regardless of the payment method chosen, double-check that you’ve entered your account number and any essential personal information accurately. Visit the Deposit section of your Personal Area on the AvaTrade platform to fund your account at your convenience, 24/7.

How to Deposit on AvaTrade

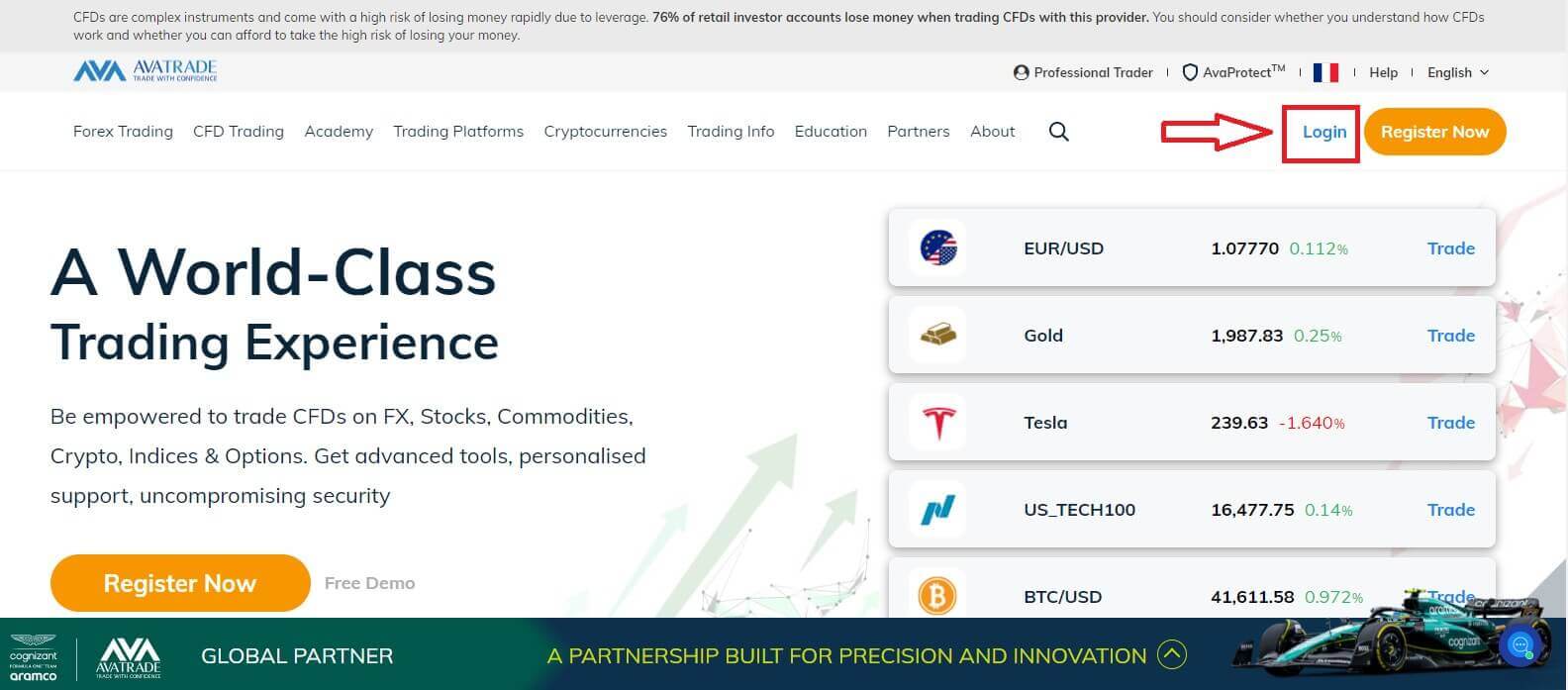

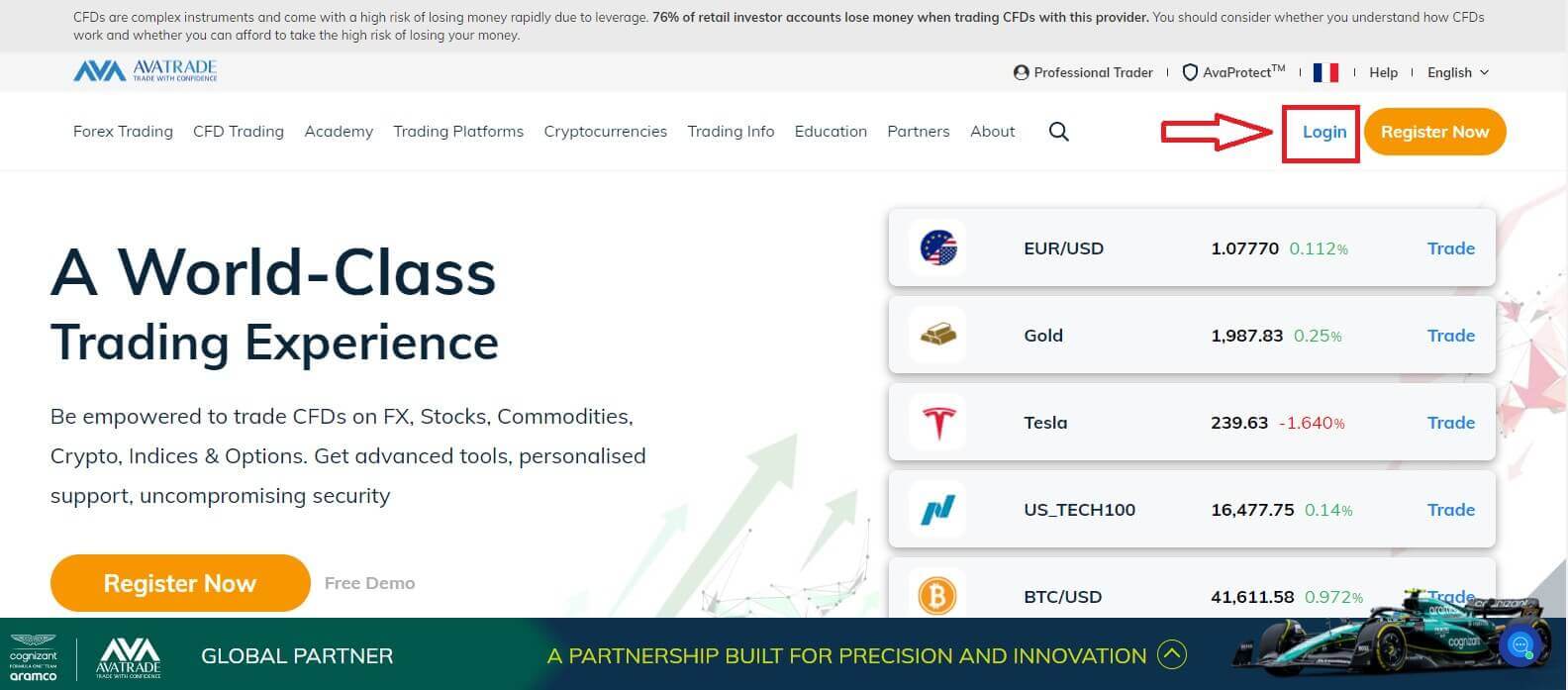

First, please access the AvaTrade website and click "Login" in the upper right corner.

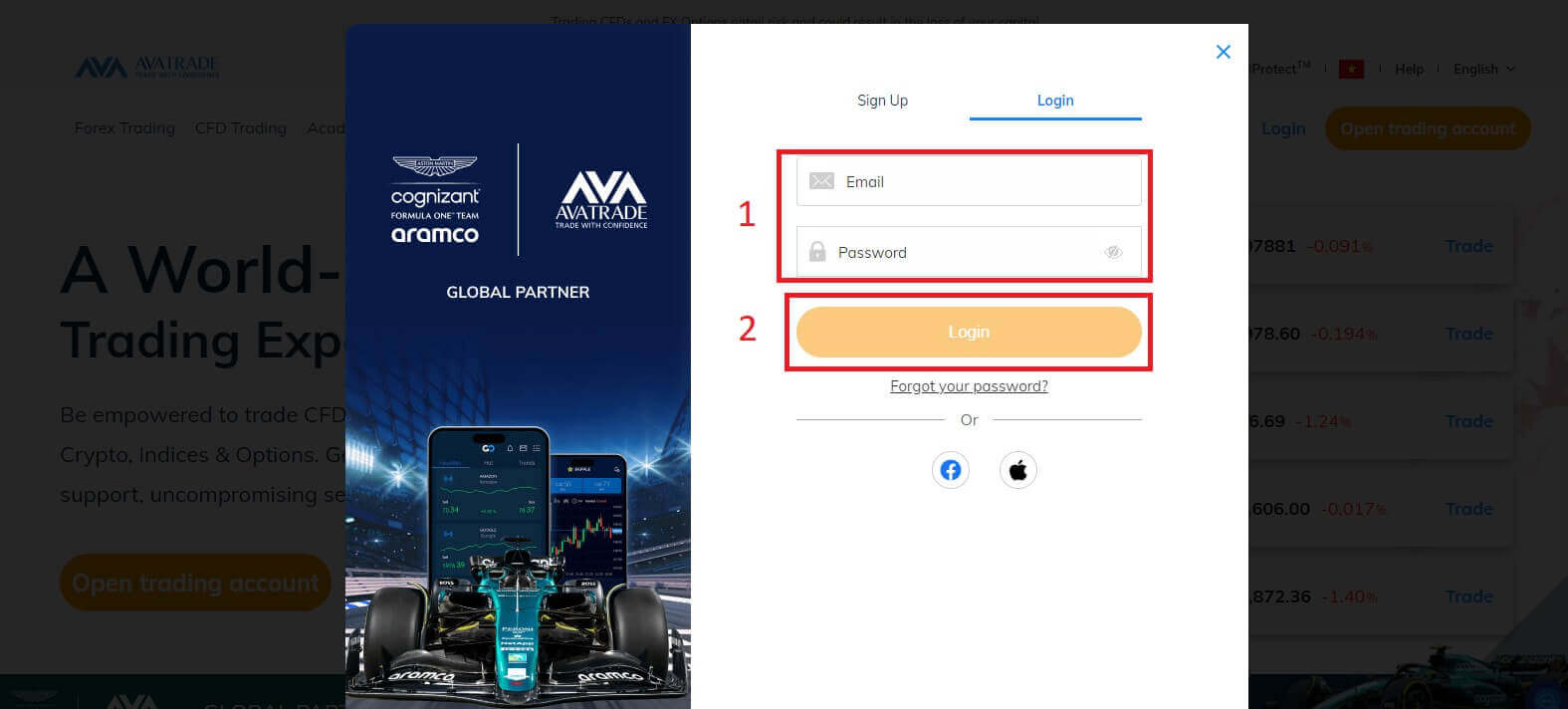

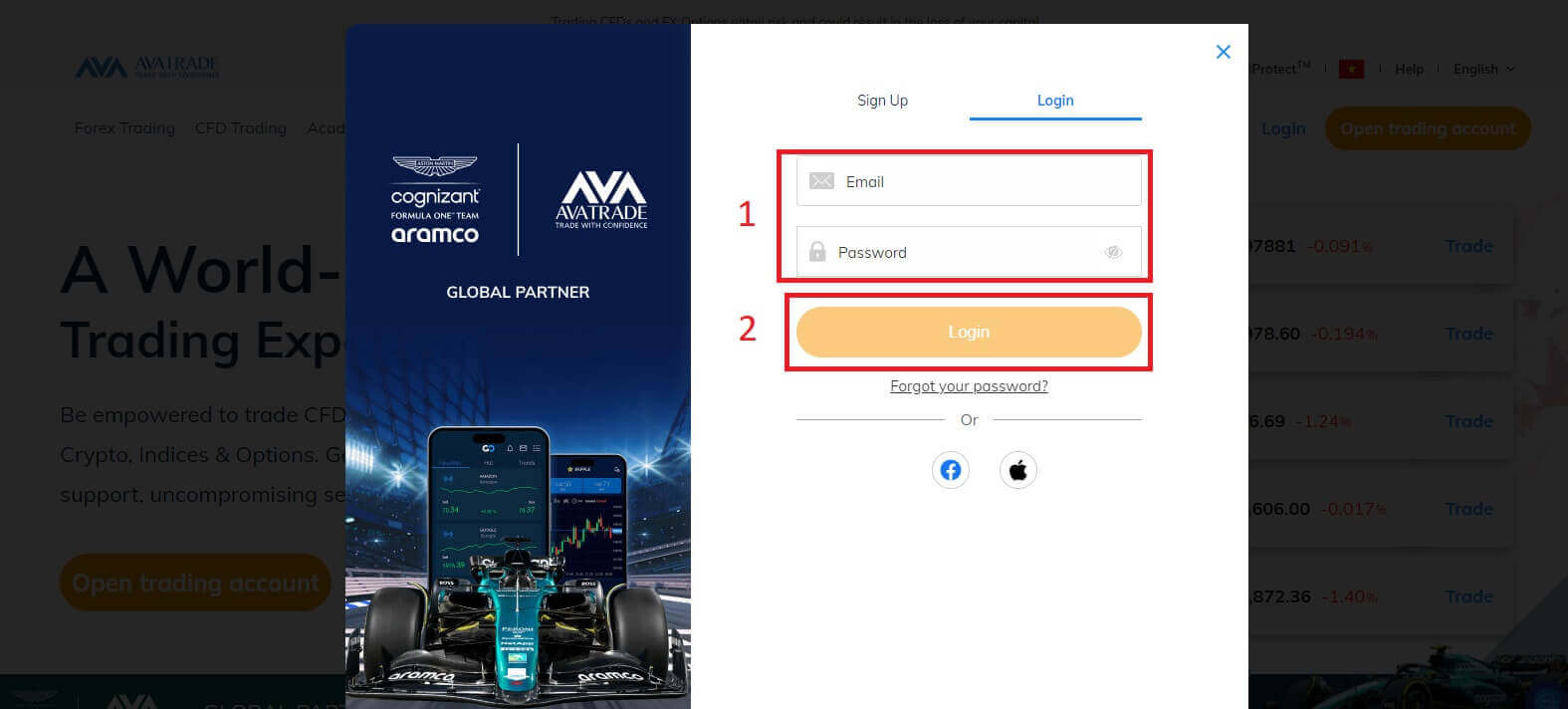

Then please fill in your registered account and choose "Login" when you finished.

If you haven’t registered an AvaTrade account, please follow this article: How to Register Account on AvaTrade.

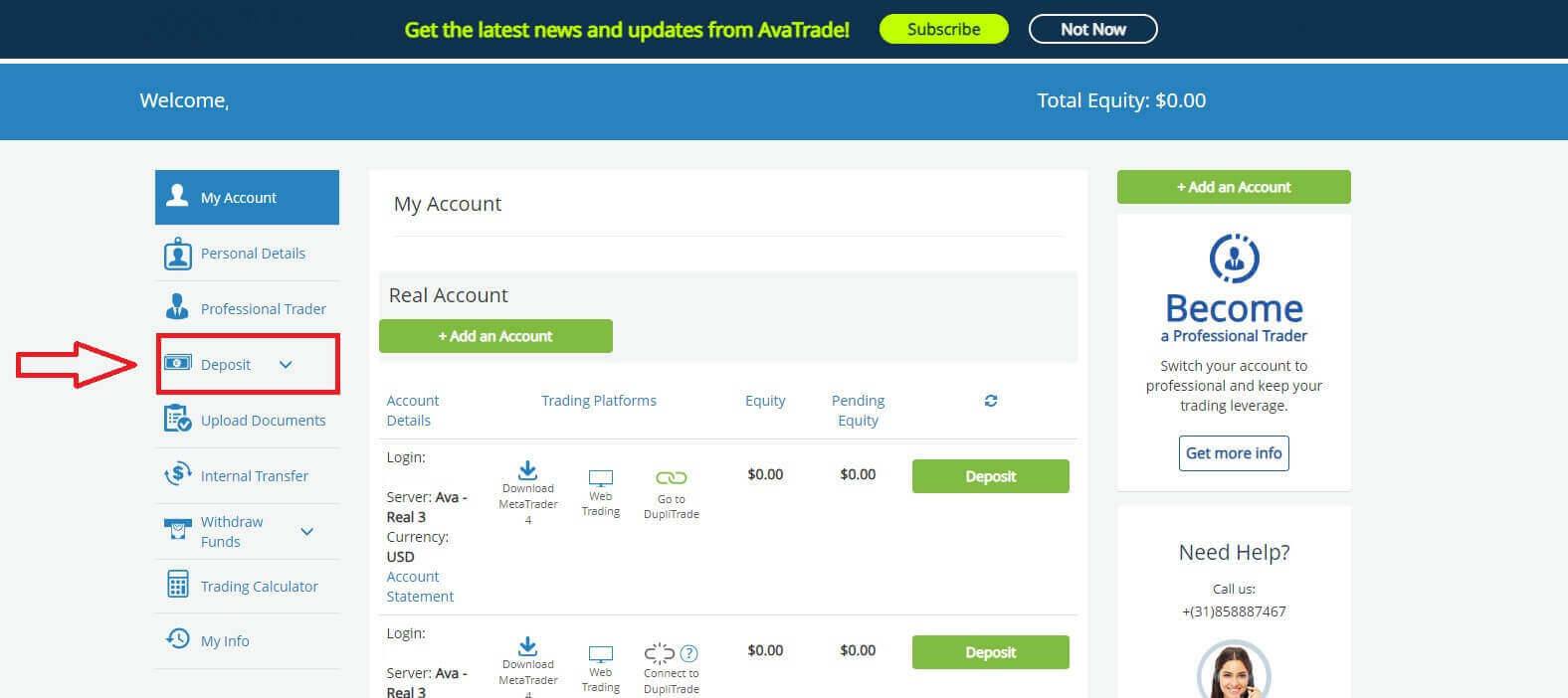

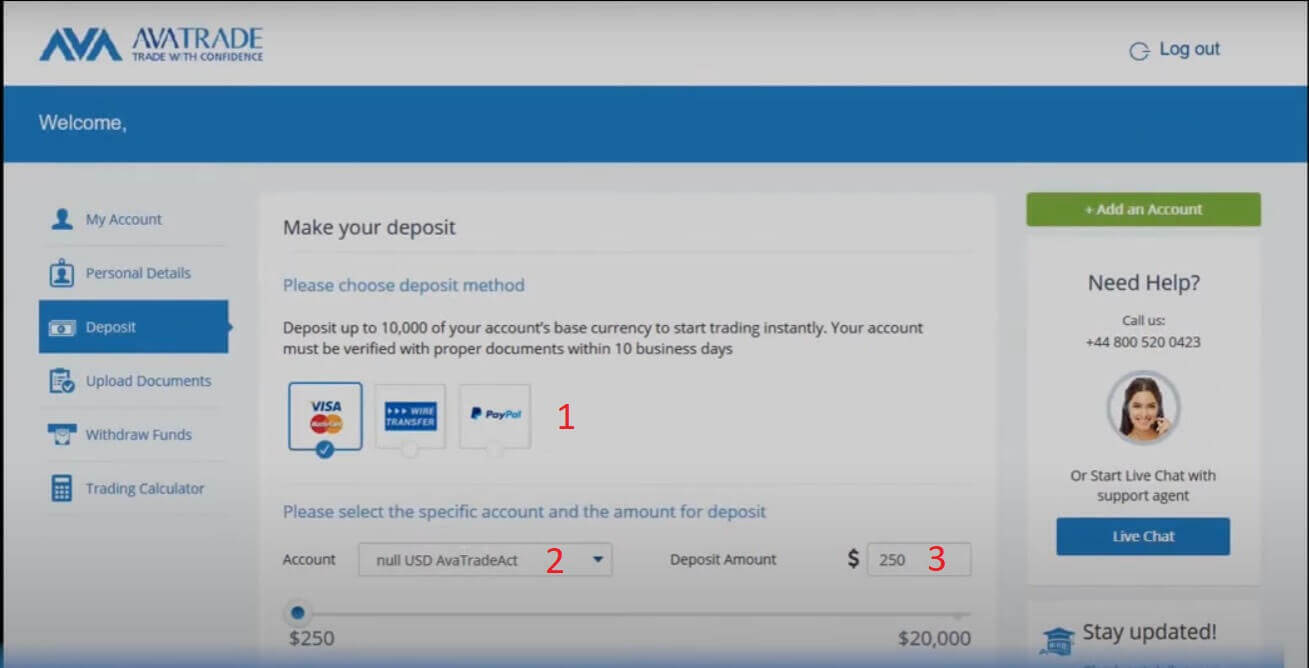

Next, select the "Deposit " tab on your left to start funding your trading account.

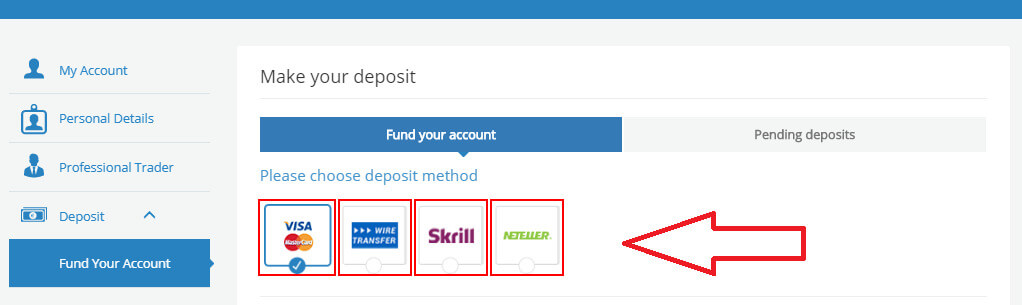

AvaTrade offers numerous deposit methods including major Credit cards and Wire Transfer. Depending on your location, you can also deposit through e-payments such as Skrill, Perfect Money, and Neteller.

When accessing the "Deposit" page, on the "Fund your account" tab, you will be able to see all and only the available payment methods for your Country. AvaTrade offers several ways of depositing money into your trading account: Credit Card, Wire Transfer, as well as several forms of e-payment (not for EU Australian clients).

If you have more than one live account, select one and the trading platform in the "Select account for deposit" section which is located in the drop-down menu. Finally, enter the amount of money you wish to deposit.

Another note is account verification is a mandatory step before making deposits. In other words, only verified accounts can proceed with deposit transactions. If your account is not yet verified, please follow the instructions in the following article: How to Verify Account on AvaTrade.

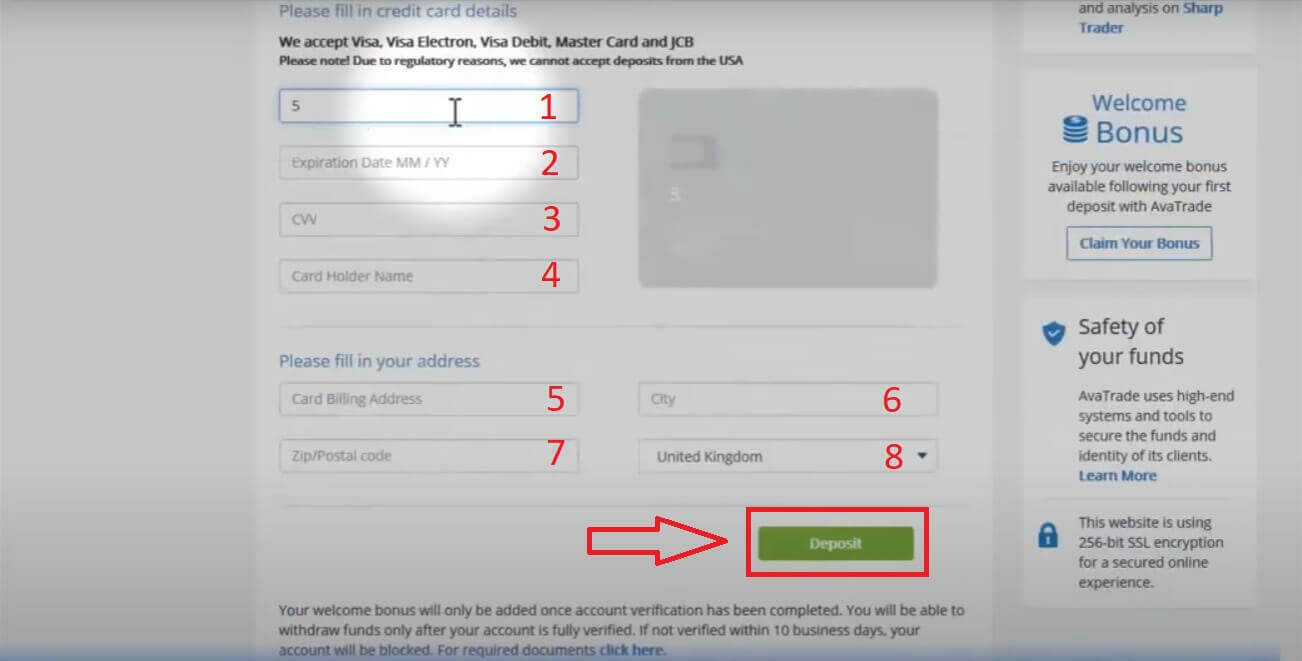

Credit Card

With this method, you will have to provide some details:

- The card number.

- The Expiration Date (MM/YY).

- The CVV.

- The Card Holder Name.

- Card Billing Address.

- The city that you currently live in.

- Your area postal code.

- Your country of residence.

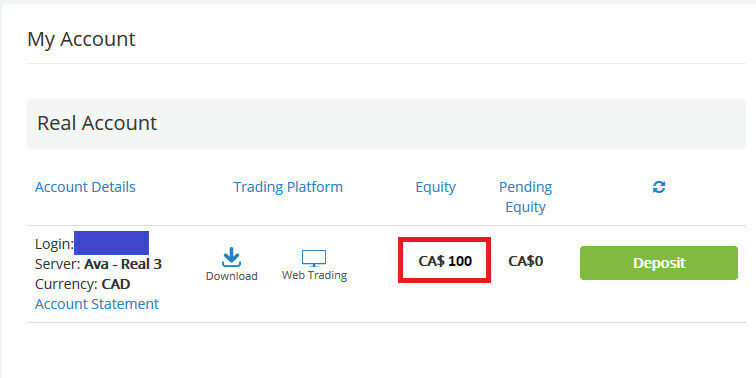

If the deposit is accepted, it will show in your Trading account Equity:

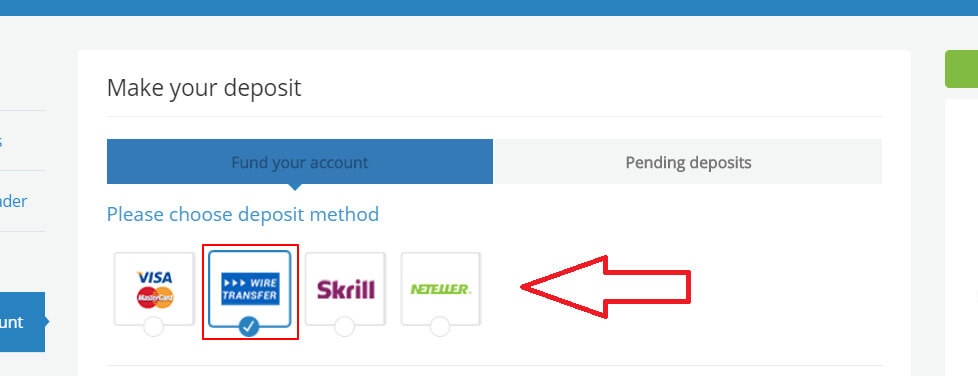

Wire Transfer

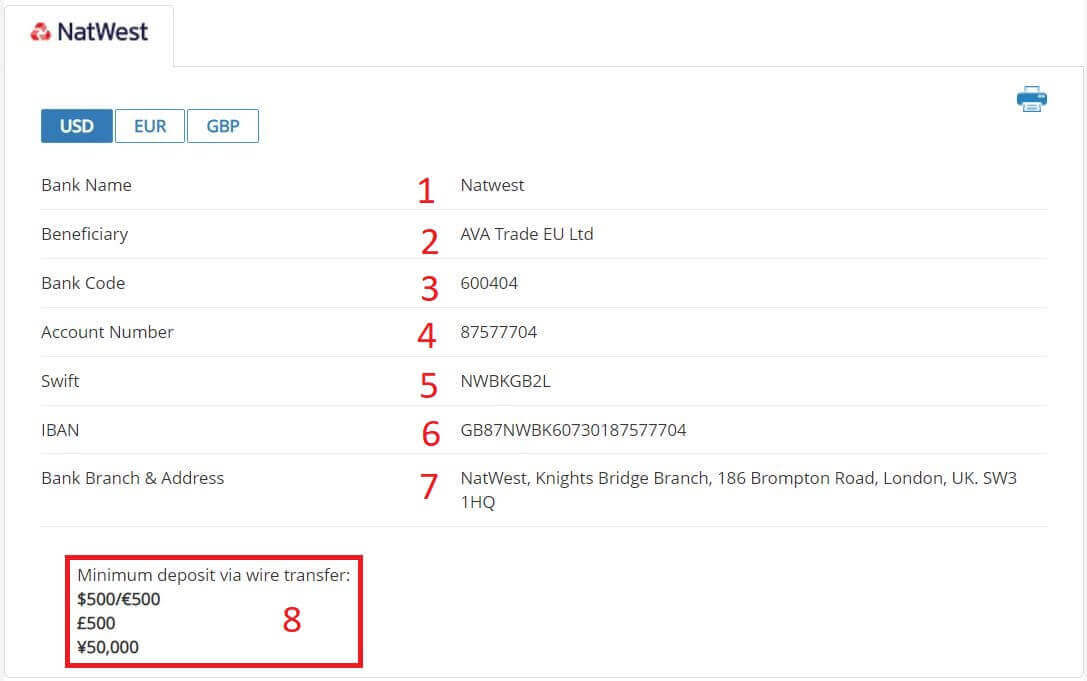

At the "Fund your account" tab, select the "WIRE TRANSFER" method.

For this method of payment, initially, you have to choose the available currencies (USD/ EUR/ GBP) in the open window.

You will see all the details, which you can either print and bring to your Bank or copy and paste into your online banking, to complete a wire transfer. They might include:

- The Bank Name.

- The Beneficiary.

- The Bank Code.

- The Account Number.

- The Swift.

- The IBAN.

- The Bank Branch Address.

- Please notice the minimum deposit amount of money via wire transfer.

Note: When ordering the wire transfer in your bank, please add your trading account number to the transfer comments so AvaTrade can allocate the funds faster.

Frequently Asked Questions (FAQ)

How long does it take to deposit?

AvaTrade offers multiple deposit methods and their processing times differ.

Before you go ahead and fund your account, please make sure that the verification process of your account is completed and that all of your uploaded documents have been approved.

If you use a regular credit/debit card, the payment should be credited instantly. If there is any delay, please contact Customer Services.

E-payments (i.e. Moneybookers (Skrill)) will be credited within 24 hours, deposits by wire transfer can take up to 10 business days, depending on your bank and country (please make sure to send us a copy of the swift code or receipt for tracking).

If this is your first credit card deposit it may take up to 1 business day to credit the funds to your account due to security verification.

- Please note: From 1/1/2021, all European banks applied a 3D security authentication code, to increase the security for online credit/debit card transactions. If you are experiencing issues with receiving your 3D secure code, we suggest contacting your bank for assistance.

-

Clients from European countries must verify their accounts before depositing.

What is the minimum amount I need to deposit to open an account?

The minimum deposit amount depends on the base currency of your account* :

Deposit Via Credit card or Wire Transfer USD account:

- USD account – $100

- EUR account – €100

- GBP account – £100

- AUD account – AUD $100

AUD is only available for Australian clients, and GBP is only available for clients from the UK.

What should I do if the credit card I used to deposit has since expired?

If your credit card has expired since your last deposit you can easily update your AvaTrade Account with your new one.

When you are ready to make your next deposit, simply log into your account and follow the regular deposit steps by entering the new credit card details and clicking on the "Deposit" button.

Your new card will appear in the Deposit section above any previously used credit card(s).

How to Withdraw from AvaTrade

Withdrawal rules on AvaTrade

Withdrawals provide you with the flexibility to access your funds at any time, 24/7. The process is simple, you can initiate withdrawals from your account through the dedicated Withdrawal section in your Personal Area, and conveniently track the transaction status in the Transaction History.

However, it’s crucial to be aware of some key guidelines for withdrawing funds:

- The withdrawal amount is capped at the free margin of your trading account, as displayed in your Personal Area.

- Withdrawals must be executed using the same payment system, account, and currency used for the initial deposit. In cases of multiple deposit methods, withdrawals should align with the proportional distribution of the deposits, although exceptions can be considered with account verification and specialist advice.

- Before withdrawing profits, a refund request must be completed to fully withdraw the amount deposited via the bank card or Bitcoin.

- Withdrawals should adhere to the payment system priority, optimizing transaction efficiency. The order is as follows: bank card refund request, bitcoin refund request, bank card profit withdrawals, and others.

Understanding these rules is vital. To illustrate, consider this example:

Suppose you deposited a total of USD 1,000, with USD 700 via a bank card and USD 300 through Neteller. Your withdrawal limits would be 70% for the bank card and 30% for Neteller.

Now, if you’ve earned USD 500 and want to withdraw everything, including profits:

- Your trading account’s free margin is USD 1,500, comprising the initial deposit and profits.

- Start with refund requests, following the payment system priority, e.g., refunding USD 700 (70%) to your bank card.

- Only after completing all refund requests can you withdraw profits, maintaining the same proportions—USD 350 (70%) to your bank card.

The payment priority system is designed to ensure compliance with financial regulations, preventing money laundering and fraud, making it an indispensable rule for AvaTrade without exceptions.

Due to anti-money laundering rules, withdrawals can only be sent via payment methods by which you funded your account. Please note that you must withdraw up to 100% of your deposit to your credit/debit card, and only then you may withdraw by another method in your own name as you instruct.

For example: if you deposited $1,000 by credit card and made a $1,200 profit, the first $1,000 you withdraw must go back to the same credit card, before you can withdraw the profits by a different method, such as wire transfer, and other e-payment methods (for non-EU clients only).

If you made a deposit via 3rd party you must withdraw 100% of the deposit transaction on the first payment method.

How to Withdraw Money from AvaTrade

First, please access the AvaTrade website and click "Login" in the upper right corner.

Then please fill in your registered account and choose "Login" when you finished.

If you haven’t registered an AvaTrade account, please follow this article: How to Register Account on AvaTrade.

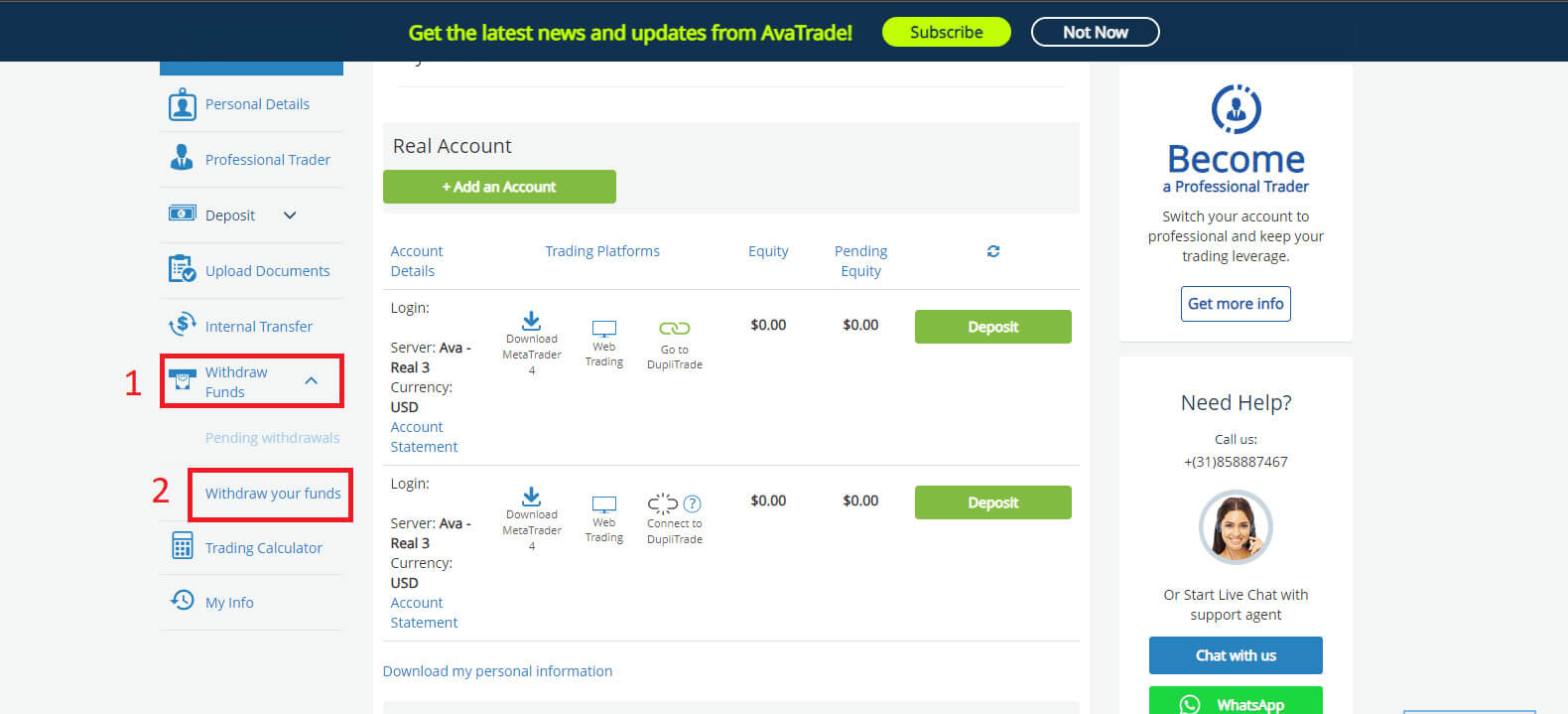

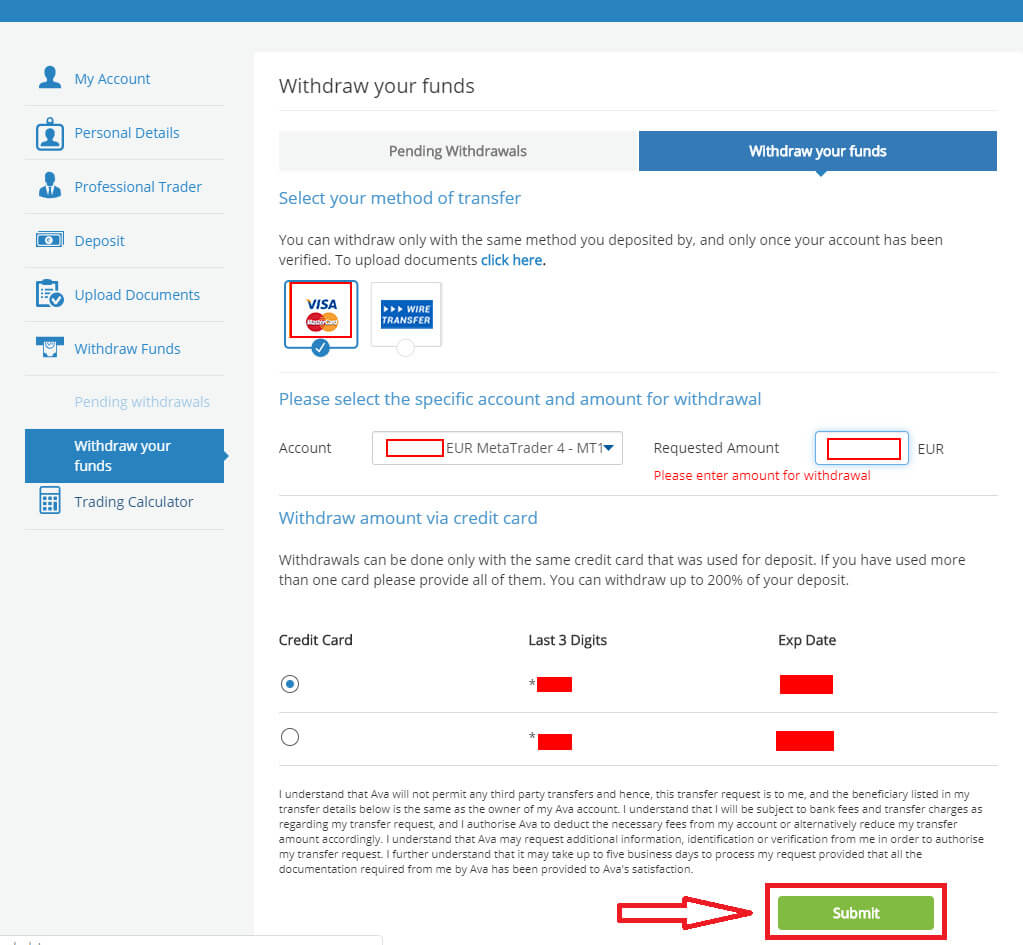

Next, select the "Withdrawal Funds" tab on your left and choose "Withdraw your funds" to start funding your trading account.

Then fill in the withdrawal form to start the process. Please follow these steps to withdraw correctly:

- Select your method of transfer: this may vary depending on your country of residence. However, the 2 most popular are via Credit Card and Wire Transfer. Select your preferred method of withdrawal, then scroll down to the next tab.

- At the next tab, if you have more than one real account that is available to withdraw, please choose one from the drop-down menu. After that, please enter the amount of money that you wish to withdraw in the "Requested Amount" blank (please note that AvaTrade covers the bank transfer fee for withdrawal requests of up to $/€/£ 100). Therefore, the amount you withdrew by Bank Transfer might not be the same as that received in my Bank Account. However, If you encounter a discrepancy in the received Wire Transfer amount that does not match any of the above options, please send AvaTrade a bank statement showing the transfer and any related fees. The Customer Services Team will investigate it.

- Choose the card you wish to receive money. Another notice is withdrawals can only be done with the same card that you used to deposit into your account, so if you used more than 1 card, please provide all of them. In addition, the maximum you can withdraw is 200% of your deposit.

Withdrawals are typically processed and sent within 1 business day.

Once the withdrawal is approved and processed, it may take some additional days to receive the payment:

-

For Credit/Debit Cards - up to 5 business days.

-

For e-wallets - 24 hours.

-

For Wire transfers - up to 10 business days (depending on your county and Bank).

Kindly note: Saturday and Sunday are not considered business days.

Frequently Asked Questions (FAQ)

Why is my withdrawal not being processed?

Usually, withdrawals are processed and sent out within 1 business day, depending on the payment method they are requested it may take some additional time to show in your statement.

-

For E-wallets, it may take 1 day.

-

For Credit/Debit cards it may take up to 5 business days

-

For wire transfers, it may take up to 10 business days.

Before requesting a withdrawal, please make sure that all requirements are met. These may include full account verification, the minimum trading of the bonus volume, sufficient usable margin, correct withdrawal method, and more.

Once all requirements are met your withdrawal will be processed.

What is the minimum trading volume required before I can withdraw my bonus?

To withdraw your bonus, you are required to execute a minimum trading volume of 20,000 in the account’s base currency, for every $1 bonus within six months.

-

The bonus will be paid out upon receipt of verification documents.

-

The level of deposit required to receive the bonus is in the base currency of your AvaTrade account.

Kindly note: If you don’t trade the required amount within the given time frame, your bonus will be canceled and removed from your trading account.

How do I cancel a Withdrawal request?

If you have made a withdrawal request within the last day and it’s still in the Pending status, you can cancel it by logging into your My Account area.

- Open the "Withdrawal Funds" tab on the left.

- There you can see the "Pending Withdrawals" section.

- Click on it and mark the withdrawal request you wish to cancel by selecting the box.

- At this point, you can click on the "Cancel withdrawals" button.

- The funds will return to your trading account and the request is canceled.

Please note: Withdrawal requests are processed within 24 business hours of the time they are requested (Saturdays and Sundays are not considered business days).